With a market cap of $54.7 billion, The Allstate Corporation (ALL) is a leading property-casualty insurer and the largest publicly held personal lines carrier in the U.S., offering a variety of insurance and investment products. It operates across multiple segments and distributes its products through agents, call centers, retailers, and digital platforms.

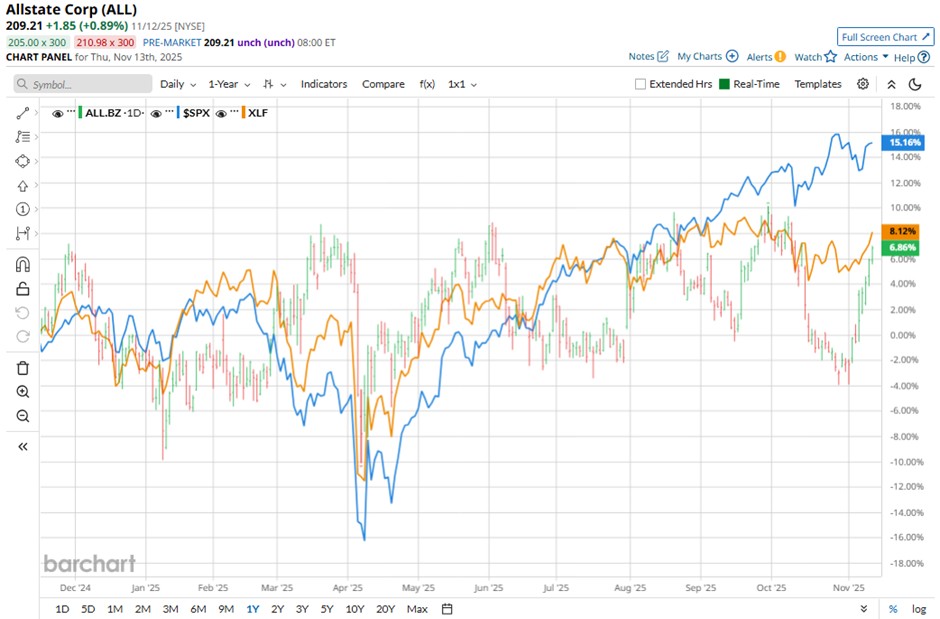

The insurance giant's shares have underperformed the broader market over the past 52 weeks. ALL stock has risen 5.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.5%. Moreover, shares of the company are up 8.5% on a YTD basis, compared to SPX’s 16.5% gain.

In addition, shares of the Northbrook, Illinois-based company have also lagged behind the Financial Select Sector SPDR Fund’s (XLF) 7.8% return over the past 52 weeks.

Shares of Allstate rose 1.7% following its Q3 2025 results on Nov. 5 as adjusted EPS of $11.17 surged from $3.91 a year ago and beat estimates, reflecting strong operational recovery. The company’s pretax income jumped to $4.8 billion from $1.4 billion, driven by a 13.5% decline in total costs and expenses and a sharp reduction in catastrophe losses to $558 million from $1.7 billion.

For the fiscal year ending in December 2025, analysts expect ALL’s adjusted EPS to surge 51.4% year-over-year to $27.73. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

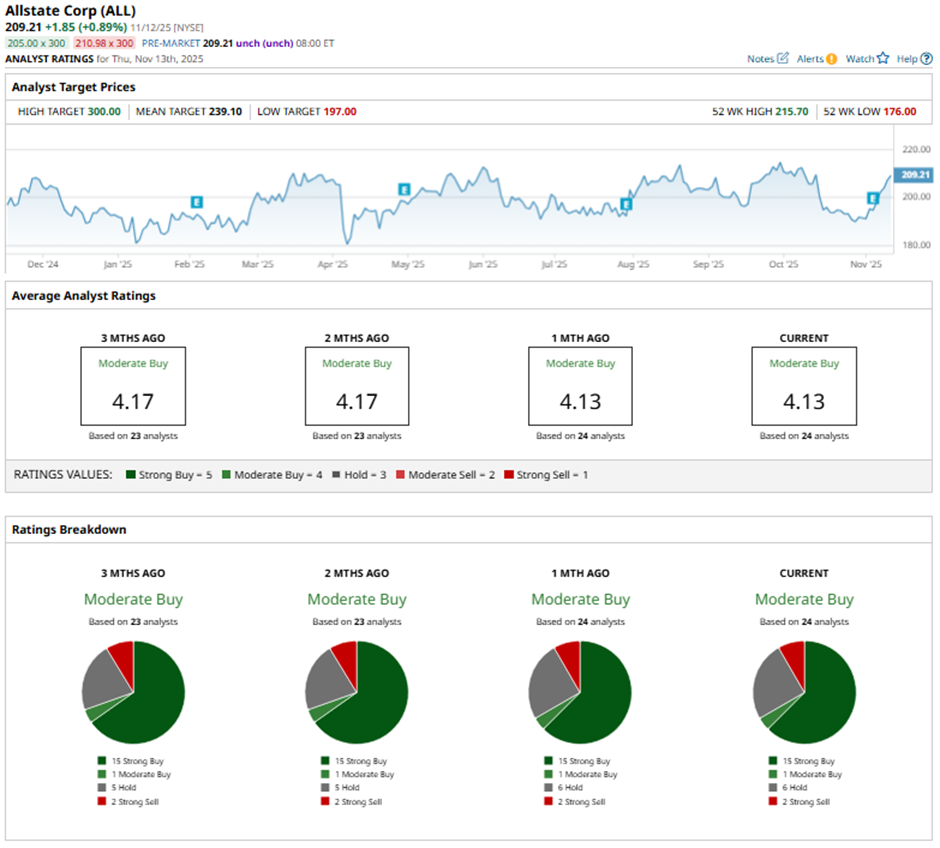

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, one “Moderate Buy,” six “Holds,” and two “Strong Sells.”

On Nov. 7, Wells Fargo raised its price target on Allstate to $216 and kept an “Equal Weight” rating.

The mean price target of $239.10 represents a 14.3% premium to ALL’s current price levels. The Street-high price target of $300 suggests a 43.4% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Stock Is a High-Stakes Trade Ahead of November 19. How to Hedge the Risk of a Post-Earnings Plunge.

- Turned Off by Palantir Stock’s Steep Valuation? Consider This Cheaper ‘Mini PLTR’ Instead

- This Semiconductor Stock Has Gained More Than 425% in the Past Year

- Supermicro Stock Slips 33% in a Month: Should You Buy, Sell, or Hold SMCI?