In Wednesday’s unusual options activity, there were 1,025 calls and puts, with Vol/OI (volume-to-open-interest) ratios ranging from 1.24 to 187.91 for NuScale Power (SMR).

Among the top 35 options for Vol/OI ratios, two stocks jump out to me as potential straddle candidates. Whether bullish or bearish, both are recognizable household names.

For those unfamiliar, there are long straddles and short straddles.

The former involves buying a call and a put option at identical strike prices and the same expiration date. The long straddle strategy anticipates volatility to rise and the stock to move significantly in either direction.

The latter involves selling a call and a put option at identical strike prices and the same expiration date. The short straddle strategy anticipates volatility decreasing and the stock trading within a specific range.

The long straddle is a directional, speculative bet, while the short straddle is about income generation.

Here are the two stocks from yesterday. For each, I’ll decide whether to do a long or short straddle.

Bristol-Myers Squibb (BMY)

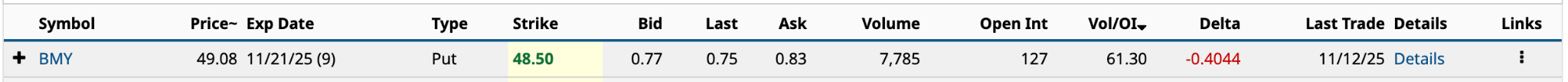

Although Bristol-Myers Squibb (BMY) had six unusually active options yesterday, I'm interested in the Nov. 21 $48.50 put. It had the fifth-highest Vol/OI ratio on the day.

For a long straddle to make sense, there would generally be an upcoming catalyst, such as an earnings report or a potential acquisition, that could significantly move a stock’s share price.

BMY reported its latest earnings on Oct. 30. They were better than expected, beating analyst estimates on both the top and bottom lines. As a result, the drug company raised its 2025 guidance. It now expects revenues of $47.75 billion at the midpoint and earnings per share of $6.50.

Bristol-Myers’ shares are up 16% since announcing earnings in late October. Given that the stock has had only six moves of 5% or more in a single day’s trading over the past 12 months, it’s unlikely to deliver much more appreciation over the next nine days. Further, the Barchart Technical Opinion is a weak sell, indicating it’s likely to remain rangebound through the Nov. 21 expiration.

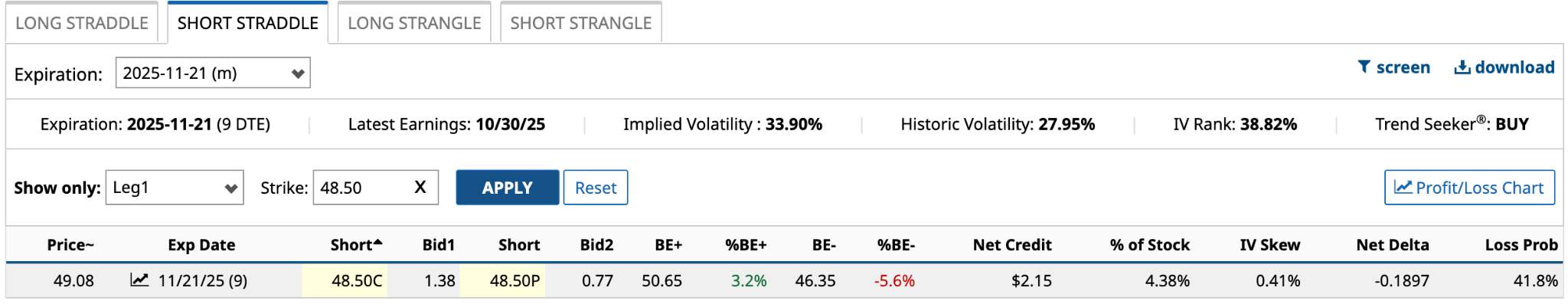

Therefore, BMY is a short straddle opportunity in my opinion.

In this case, selling a $48.50 call and $48.50 put generates a net credit of $215, or 4.38% of the stock price. On an annualized basis, that’s a return of $177.6%.

As long as the shares remain between the upper breakeven of $50.65 and the lower breakeven of $46.35. You would achieve the $215 maximum profit if the share price equals the $48.50 strike price at expiration. It’s important to note this trade is not without risk. Should news surface to move the share price above the upper or lower breakeven, the loss is unlimited. That said, it’s improbable, if not impossible.

Bath & Body Works (BBWI)

Bath & Body Works (BBWI) had four unusually active options yesterday. I'm interested in the Nov. 21 $21.50 put. It had the 14th-highest Vol/OI ratio on the day.

Coincidentally, I wrote about the specialty retailer in my Wednesday commentary about stocks hitting new 52-week highs and lows. BBWI stock hit its 26th new 52-week low of the past 12 months yesterday. That followed a 25th new 52-week low hit the previous day.

The company has a chance to deliver on its plans to grow the top and bottom lines while improving the customer experience. That said, it’s not without its problems, most notably its heavy debt load and significantly reduced cash flow relative to historical norms.

“The most significant concern investors should have with Bath & Body Works, aside from its sales slowing since coming out of COVID, is its balance sheet. It has a total debt of $4.99 billion, which is 109% of its market cap. That’s high. Its interest expense of $292 million is 37% of its trailing 12-month free cash flow,” I wrote.

This isn’t a stock for your kid’s education fund. It’s more for someone who is risk-tolerant and doesn’t mind taking the occasional flyer.

Long or short straddle? The expected move over the next seven business days through the put’s Nov. 21 expiration date is 10.22% or $2.28. That’s reasonably high. I’d be more inclined to go with the long straddle, given that the 102.02% implied volatility is relatively high.

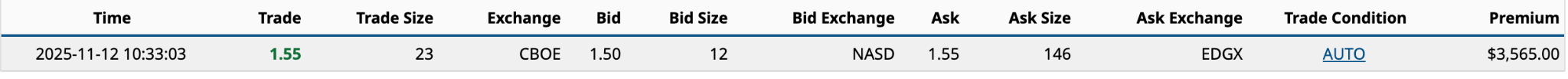

Using the $1.50 ask price from the put and the $1.55 ask price for the call from yesterday’s one large trade -- more than 10 contracts -- you get a net debit of $3.05 or 13.6% of yesterday’s $22.40 closing share price. That’s higher than 10%, which I usually avoid, and even though it’s above the expected move, I’ve got a hunch volatility will persist through the company’s Q3 2025 earnings report, out next Thursday before the markets open.

Using the $1.50 ask price from the put and the $1.55 ask price for the call from yesterday’s one large trade -- more than 10 contracts -- you get a net debit of $3.05 or 13.6% of yesterday’s $22.40 closing share price. That’s higher than 10%, which I usually avoid, and even though it’s above the expected move, I’ve got a hunch volatility will persist through the company’s Q3 2025 earnings report, out next Thursday before the markets open.

Remember, to make money on this long straddle, the share price at expiration must be above $24.55 or below $18.45. BBWI last traded above $24.55 on Oct. 29 and below $18.45 in June/July 2020. If you’re speculative play is successful, it is likely to be on the upside.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Two Straddles Define Wednesday’s Unusual Options Activity Across Key Stocks

- Nvidia Stock Is a High-Stakes Trade Ahead of November 19. How to Hedge the Risk of a Post-Earnings Plunge.

- United Airlines (UAL): Hidden Behind the Shutdown Deal is a Secret Informational Arbitrage Opportunity

- AMD’s $350 Price Target Is In: This Options Trade Is the Data-Driven Winner