Entergy Corporation (ETR) powers everyday life for 3 million customers across Arkansas, Louisiana, Mississippi, and Texas, delivering reliable, resilient, and affordable electricity through its operating companies. As it builds for the future, Entergy is modernizing the energy grid, strengthening system resilience, and expanding cleaner energy sources, including natural gas, nuclear, and renewables.

Recognized nationally for its leadership in sustainability and corporate citizenship, Entergy also gives back more than $100 million annually to local communities through philanthropy, volunteerism, and advocacy. Currently valued at a market capitalization of about $43 billion, the Louisiana-based company plans to release its fiscal 2025 fourth-quarter earnings on Feb. 12, 2026.

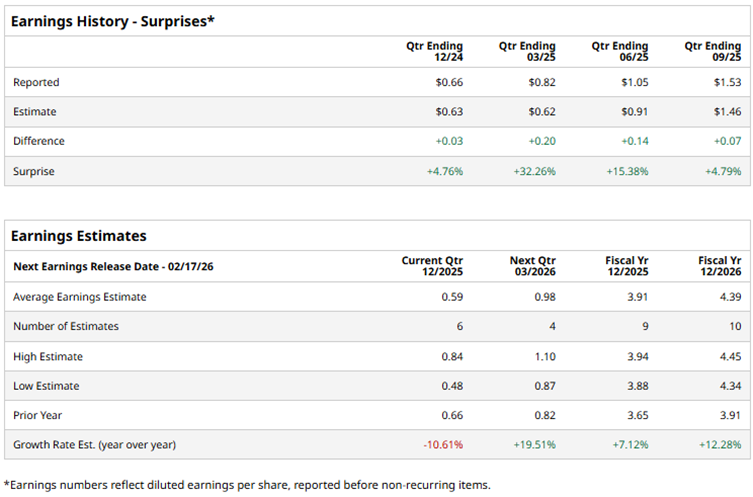

And ahead of this event, Wall Street is projecting a 10.6% year-over-year drop in Q4 earnings to $0.59 per share. Still, the company enters the results with credibility, having beaten analysts’ bottom-line estimates in each of the past four quarters. Looking further ahead, analysts expect the company’s full-year 2025 EPS to come in at $3.91, up 7.1% year over year, followed by another 12.3% rise to $4.39 in 2026.

ETR stock delivered a solid showing in 2025, climbing 18.6% and comfortably outperforming both the broader S&P 500 Index’s ($SPX) 16.9% rise and the Utilities Select Sector SPDR Fund’s (XLU) 10.2% return over the same period, highlighting its relative strength in a steady but competitive sector.

In its third-quarter earnings report released last October, Entergy exceeded Wall Street’s expectations for both revenue and earnings, supported by rising electricity demand linked to a growing pipeline of artificial intelligence (AI)-driven data center customers. The company reported total revenue of $3.8 billion, above the consensus estimate of $3.5 billion, while adjusted EPS of $1.53 also came in higher than the anticipated $1.46.

Overall, Wall Street remains firmly optimistic about Entergy’s prospects. The stock currently sports a consensus “Strong Buy” rating, reflecting broad analyst confidence in its outlook. Out of 22 analysts covering the company, a clear majority of 15 recommend a “Strong Buy,” while one calls it a “Moderate Buy,” and just six take a more cautious “Hold” stance. The average price target of $104.97 implies potential upside of about 8.9% from current levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?