Household products company Spectrum Brands (NYSE:SPB) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 5.2% year on year to $733.5 million. Its non-GAAP profit of $2.61 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Spectrum Brands? Find out by accessing our full research report, it’s free for active Edge members.

Spectrum Brands (SPB) Q3 CY2025 Highlights:

- Revenue: $733.5 million vs analyst estimates of $741.3 million (5.2% year-on-year decline, 1.1% miss)

- Adjusted EPS: $2.61 vs analyst estimates of $0.91 (significant beat due to tax benefit)

- Adjusted EBITDA: $63.4 million vs analyst estimates of $63.88 million (8.6% margin, 0.7% miss)

- Operating Margin: 4%, up from 2.8% in the same quarter last year

- Free Cash Flow Margin: 21.5%, up from 8.8% in the same quarter last year

- Organic Revenue fell 6.6% year on year vs analyst estimates of 5.2% declines (144.8 basis point miss)

- Market Capitalization: $1.29 billion

"Earlier in the year, we made the difficult but necessary decision to address the uncertain trade policy by halting all imports from China for the US market and focus on running the business for cash. Our fourth quarter and full year results reflect the impacts of those decisions and a challenging macroeconomic environment. Despite these headwinds, the actions we proactively and decisively took reduced our risk significantly and protected our long-term financial health. We delivered adjusted free cash flow of over $170 million, exceeding by $10 million our previously communicated goal of $160 million. As expected, our Home & Garden (H&G) business delivered topline growth for the quarter, driven by a delayed start to the season while category softness continued to impact both our Global Pet Care (GPC) and Home and Personal Care (HPC) businesses. Our results were also impacted by the decision to stop shipments earlier in the year resulting in continued supply shortages in the fourth quarter. Looking forward to fiscal 2026, we expect our two highest value businesses, GPC and H&G, to return to growth as we see signs of stabilization in these categories. Our HPC business is expected to be challenged by continued category softness and impacted by our supply chain simplification initiatives. Our focus for HPC is on increasing profitability and finding a strategic solution for the business." said David Maura, Chairman and Chief Executive Officer of Spectrum Brands.

Company Overview

A leader in multiple consumer product categories, Spectrum Brands (NYSE:SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $2.81 billion in revenue over the past 12 months, Spectrum Brands carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

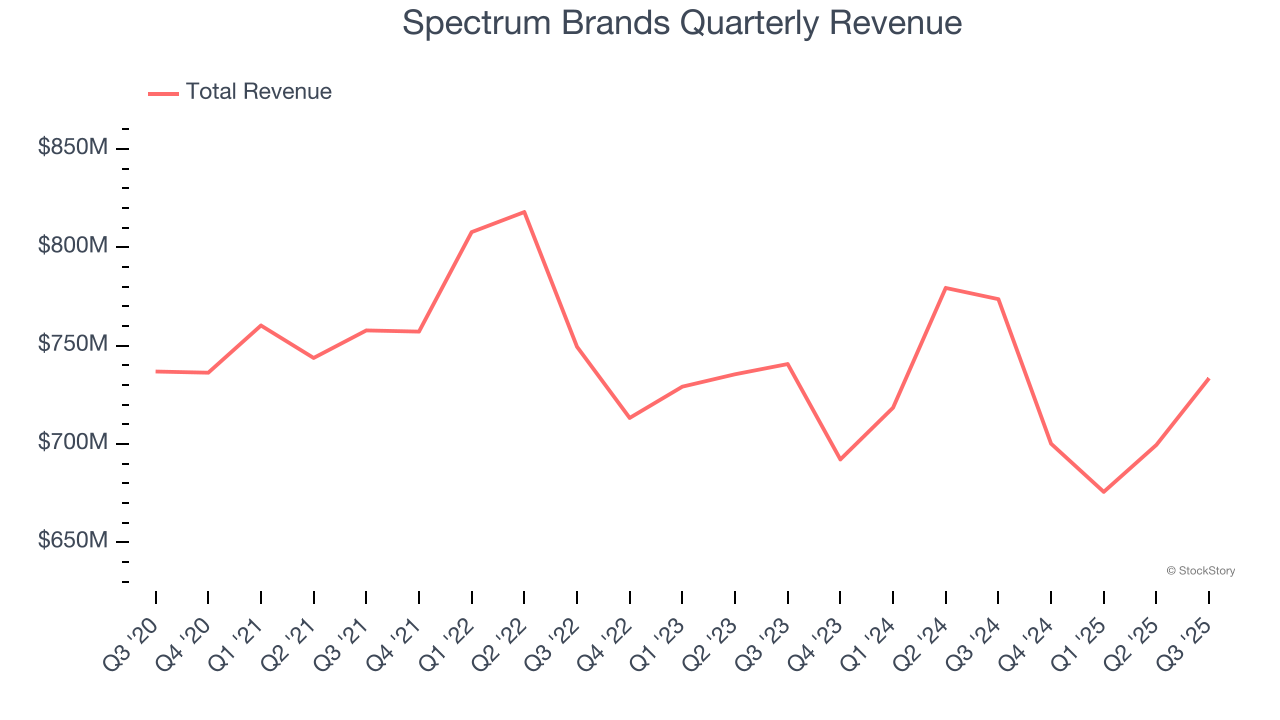

As you can see below, Spectrum Brands’s demand was weak over the last three years. Its sales fell by 3.6% annually, a rough starting point for our analysis.

This quarter, Spectrum Brands missed Wall Street’s estimates and reported a rather uninspiring 5.2% year-on-year revenue decline, generating $733.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products will fuel better top-line performance, it is still below average for the sector.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Organic Revenue Growth

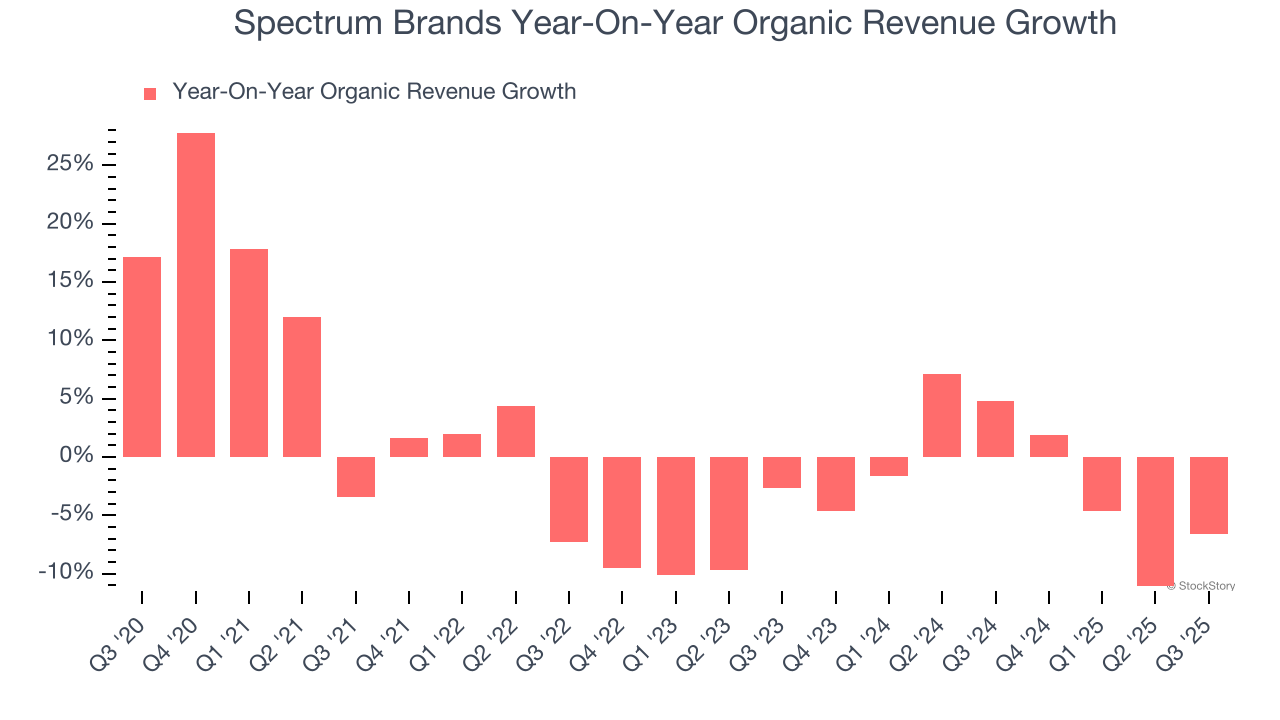

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

Spectrum Brands’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 1.8% year on year.

In the latest quarter, Spectrum Brands’s organic sales fell by 6.6% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Spectrum Brands’s Q3 Results

It was good to see Spectrum Brands beat analysts’ EPS expectations this quarter. On the other hand, its gross margin missed and its organic revenue fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $53.24 immediately following the results.

Is Spectrum Brands an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.