The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Ingersoll Rand (NYSE:IR) and the rest of the gas and liquid handling stocks fared in Q3.

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 11 gas and liquid handling stocks we track reported a satisfactory Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.6% below.

In light of this news, share prices of the companies have held steady as they are up 2.9% on average since the latest earnings results.

Ingersoll Rand (NYSE:IR)

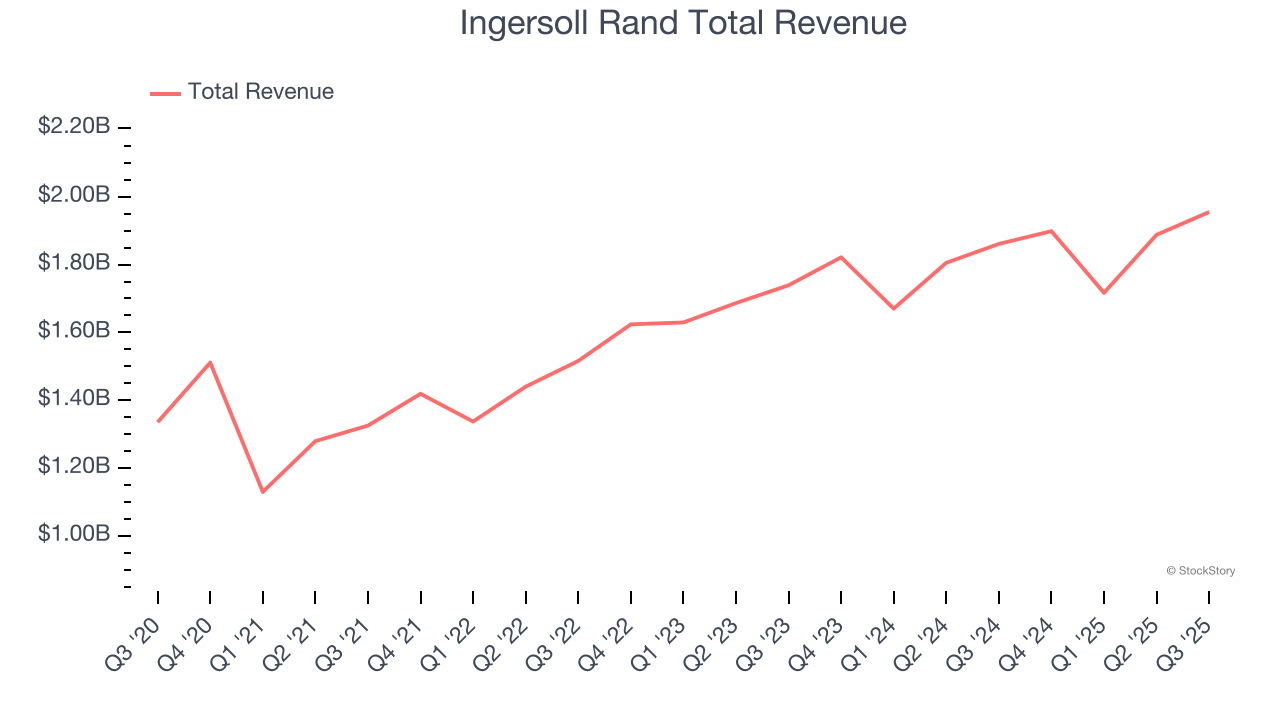

Started with the invention of the steam drill, Ingersoll Rand (NYSE:IR) provides mission-critical air, gas, liquid, and solid flow creation solutions.

Ingersoll Rand reported revenues of $1.96 billion, up 5.1% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with an impressive beat of analysts’ adjusted operating income estimates but full-year EBITDA guidance missing analysts’ expectations.

“We delivered positive organic orders growth in the third quarter across both segments,” said Vicente Reynal, chairman and chief executive officer of Ingersoll Rand.

Unsurprisingly, the stock is down 3.3% since reporting and currently trades at $76.12.

Read our full report on Ingersoll Rand here, it’s free for active Edge members.

Best Q3: SPX Technologies (NYSE:SPXC)

With roots dating back to 1912 as the Piston Ring Company, SPX Technologies (NYSE:SPXC) supplies specialized infrastructure equipment for HVAC systems and detection and measurement applications across industrial, commercial, and utility markets.

SPX Technologies reported revenues of $592.8 million, up 22.6% year on year, outperforming analysts’ expectations by 2.2%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 6.7% since reporting. It currently trades at $212.04.

Is now the time to buy SPX Technologies? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Graco (NYSE:GGG)

Founded in 1926, Graco (NYSE:GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

Graco reported revenues of $543.4 million, up 4.7% year on year, falling short of analysts’ expectations by 3%. It was a softer quarter as it posted a miss of analysts’ Contractor revenue estimates and a significant miss of analysts’ revenue estimates.

The stock is flat since the results and currently trades at $81.19.

Read our full analysis of Graco’s results here.

Flowserve (NYSE:FLS)

Manufacturing the largest pump ever built for nuclear power generation, Flowserve (NYSE:FLS) manufactures and sells flow control equipment for various industries.

Flowserve reported revenues of $1.17 billion, up 3.6% year on year. This result missed analysts’ expectations by 2.7%. Aside from that, it was a very strong quarter as it logged a solid beat of analysts’ backlog estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is up 27.7% since reporting and currently trades at $67.25.

Read our full, actionable report on Flowserve here, it’s free for active Edge members.

Helios (NYSE:HLIO)

Founded on the principle of treating others as one wants to be treated, Helios (NYSE:HLIO) designs, manufactures, and sells motion and electronic control components for various sectors.

Helios reported revenues of $220.3 million, up 13.3% year on year. This number topped analysts’ expectations by 3.7%. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ organic revenue estimates and an impressive beat of analysts’ adjusted operating income estimates.

Helios delivered the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is down 4.7% since reporting and currently trades at $53.97.

Read our full, actionable report on Helios here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.