Fashion conglomerate G-III (NASDAQ:GIII) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 9.8% year on year to $839.5 million. On the other hand, next quarter’s revenue guidance of $580 million was less impressive, coming in 6.9% below analysts’ estimates. Its GAAP profit of $1.07 per share was 7.9% above analysts’ consensus estimates.

Is now the time to buy G-III? Find out by accessing our full research report, it’s free.

G-III (GIII) Q4 CY2024 Highlights:

- Revenue: $839.5 million vs analyst estimates of $807.1 million (9.8% year-on-year growth, 4% beat)

- EPS (GAAP): $1.07 vs analyst estimates of $0.99 (7.9% beat)

- Management’s revenue guidance for the upcoming financial year 2026 is $3.14 billion at the midpoint, missing analyst estimates by 2.8% and implying -1.3% growth (vs 2.5% in FY2025)

- EPS (GAAP) guidance for Q1 CY2025 is $0.10 at the midpoint, beating analyst estimates by 1.7%

- EBITDA guidance for the upcoming financial year 2026 is $312.5 million at the midpoint, below analyst estimates of $319.5 million

- Operating Margin: 8.5%, up from 6.1% in the same quarter last year

- Market Capitalization: $1.11 billion

Morris Goldfarb, G-III’s Chairman and Chief Executive Officer, said, “Fiscal 2025 was an incredible year, marked by robust top and bottom-line growth. Our world-class teams demonstrated strong execution of our strategic priorities, including bringing four new brands to market and driving outsized growth of our owned brands. We delivered record non-GAAP earnings per diluted share of $4.42, a 9% increase over last year and above our expectations, while also expanding gross margins. These results were achieved despite a very challenging operating environment, and I want to thank our global teams for their unwavering efforts.”

Company Overview

Founded as a small leather goods business, G-III (NASDAQ:GIII) is a fashion and apparel conglomerate with a diverse portfolio of brands.

Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

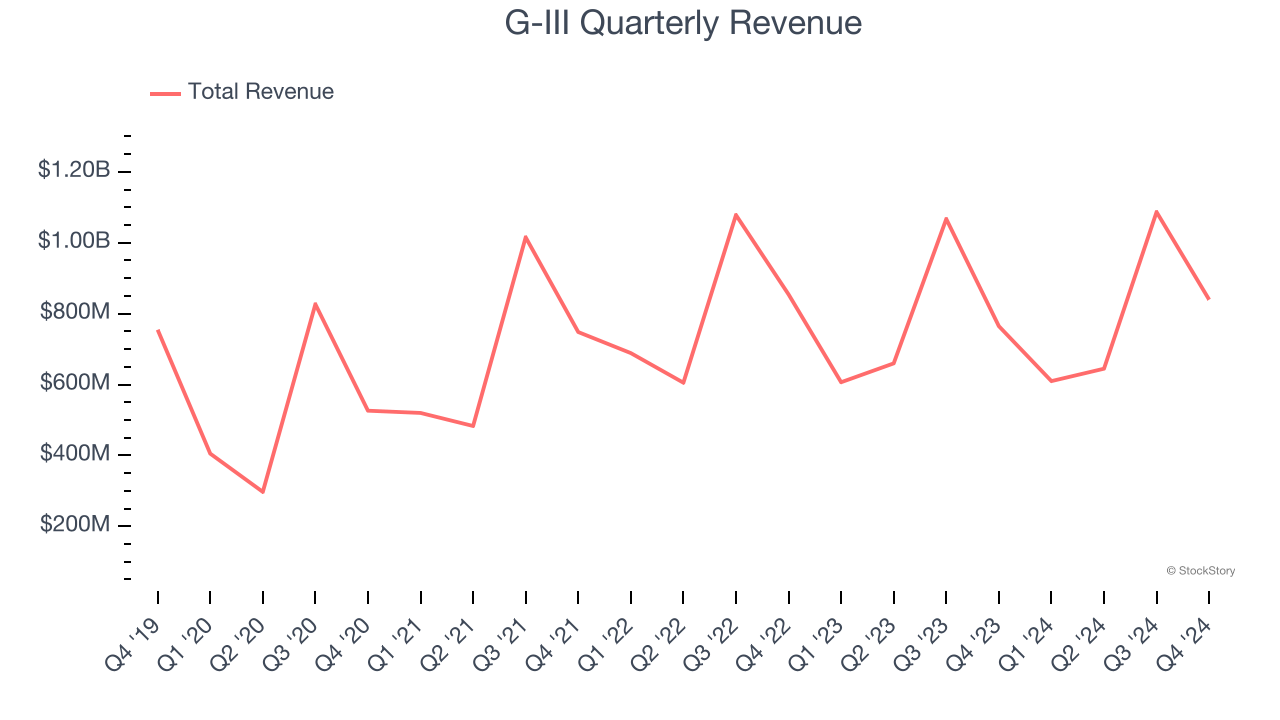

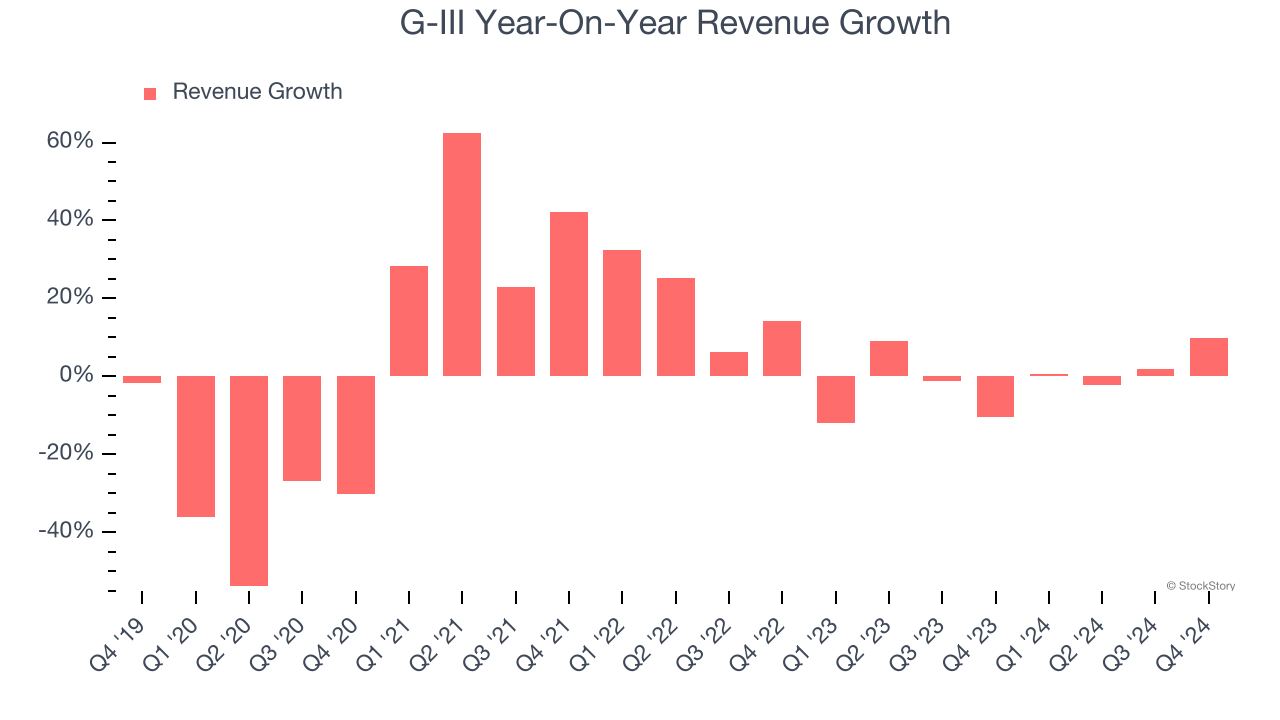

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, G-III struggled to consistently increase demand as its $3.18 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Just like its five-year trend, G-III’s revenue over the last two years was flat, suggesting it is in a slump.

This quarter, G-III reported year-on-year revenue growth of 9.8%, and its $839.5 million of revenue exceeded Wall Street’s estimates by 4%. Company management is currently guiding for a 4.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

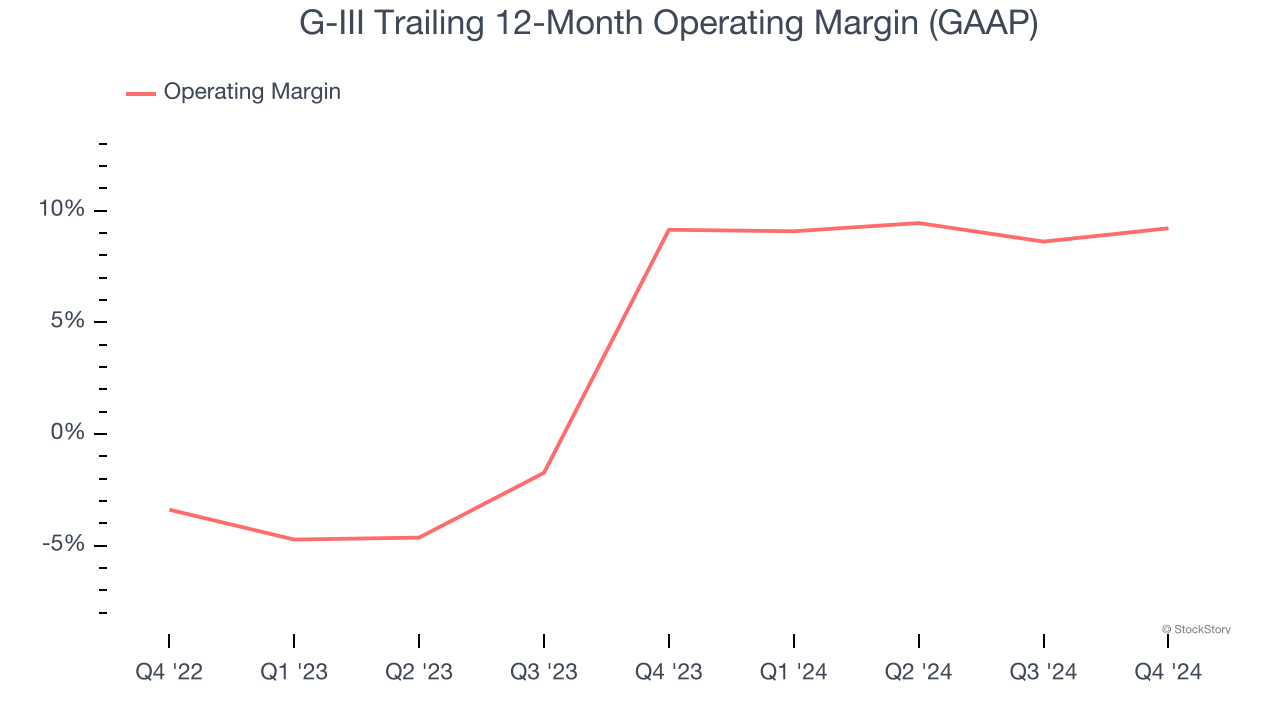

Operating Margin

G-III’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 9.2% over the last two years. This profitability was mediocre for a consumer discretionary business and caused by its suboptimal cost structure.

In Q4, G-III generated an operating profit margin of 8.5%, up 2.5 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

Earnings Per Share

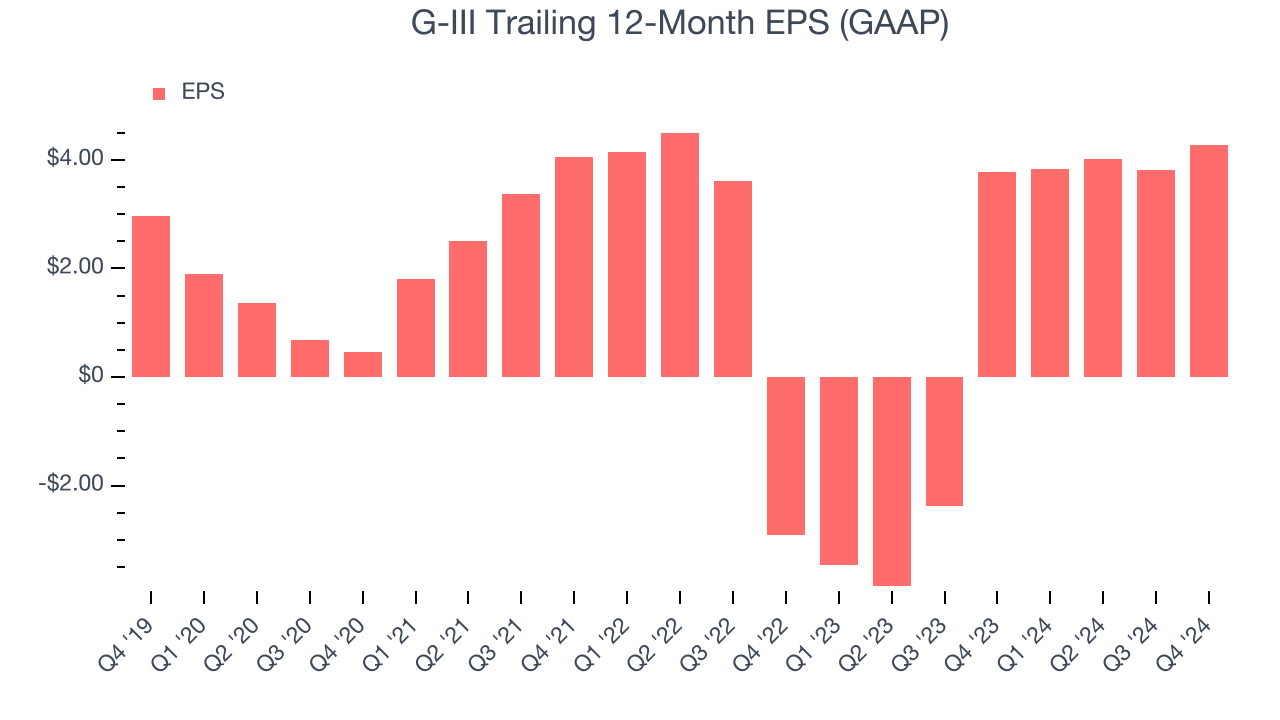

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

G-III’s EPS grew at an unimpressive 7.6% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

In Q4, G-III reported EPS at $1.07, up from $0.61 in the same quarter last year. This print beat analysts’ estimates by 7.9%. Over the next 12 months, Wall Street expects G-III’s full-year EPS of $4.28 to shrink by 5.2%.

Key Takeaways from G-III’s Q4 Results

We enjoyed seeing G-III beat analysts’ revenue expectations this quarter. We were also glad its EPS guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded up 2.1% to $25.88 immediately following the results.

Big picture, is G-III a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.