What a brutal six months it’s been for Parsons. The stock has dropped 28.9% and now trades at $68, rattling many shareholders. This might have investors contemplating their next move.

Following the pullback, is now the time to buy PSN? Find out in our full research report, it’s free.

Why Does Parsons Spark Debate?

Delivering aerospace technology during the Cold War-era, Parsons (NYSE:PSN) offers engineering, construction, and cybersecurity solutions for the infrastructure and defense sectors.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Parsons’s 11% annualized revenue growth over the last five years was impressive. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

2. Outstanding Long-Term EPS Growth

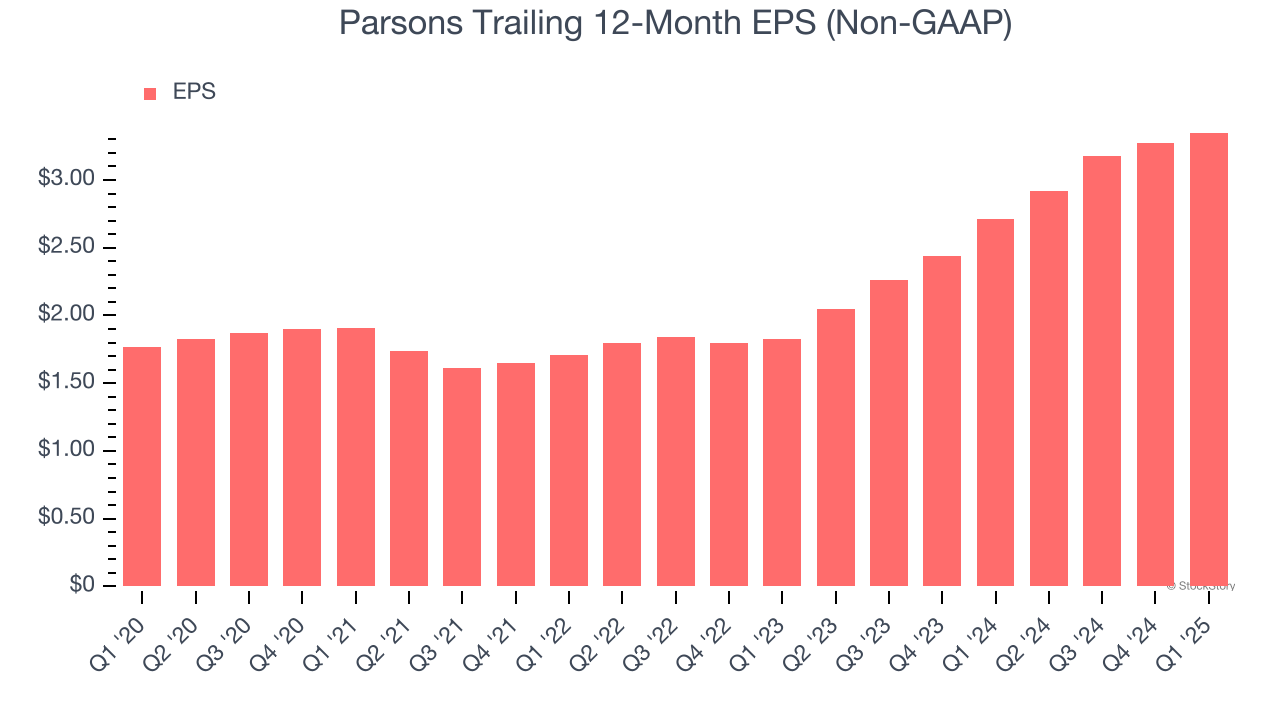

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Parsons’s EPS grew at a remarkable 13.6% compounded annual growth rate over the last five years, higher than its 11% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Weak Backlog Growth Points to Soft Demand

In addition to reported revenue, backlog is a useful data point for analyzing Defense Contractors companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Parsons’s future revenue streams.

Parsons’s backlog came in at $9.07 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 3.9%. This performance was underwhelming and suggests that increasing competition is causing challenges in winning new orders.

Final Judgment

Parsons’s merits more than compensate for its flaws. With the recent decline, the stock trades at 18.1× forward P/E (or $68 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Parsons

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.