Paycom’s 12.1% return over the past six months has outpaced the S&P 500 by 11%, and its stock price has climbed to $232.23 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy PAYC? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does Paycom Spark Debate?

Founded in 1998 as one of the first online payroll companies, Paycom (NYSE:PAYC) provides software for small and medium-sized businesses (SMBs) to manage their payroll and HR needs in one place.

Two Things to Like:

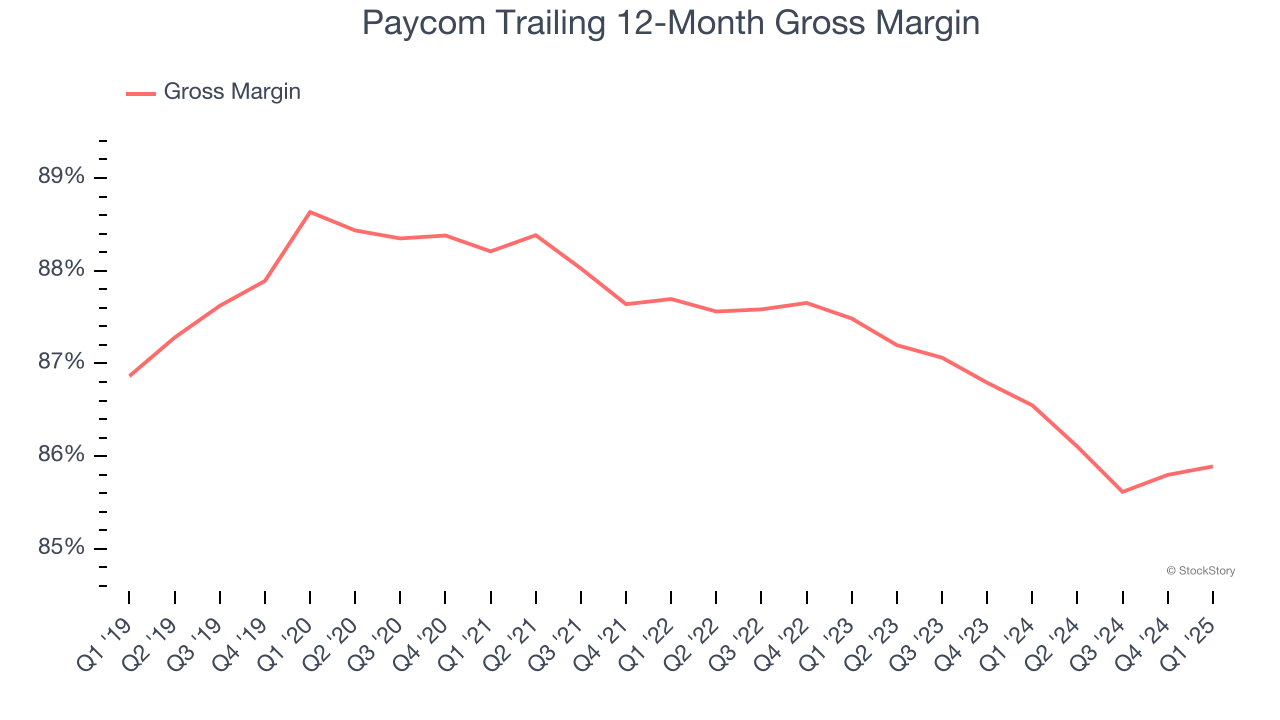

1. Elite Gross Margin Powers Best-In-Class Business Model

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Paycom’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 85.9% gross margin over the last year. That means Paycom only paid its providers $14.11 for every $100 in revenue.

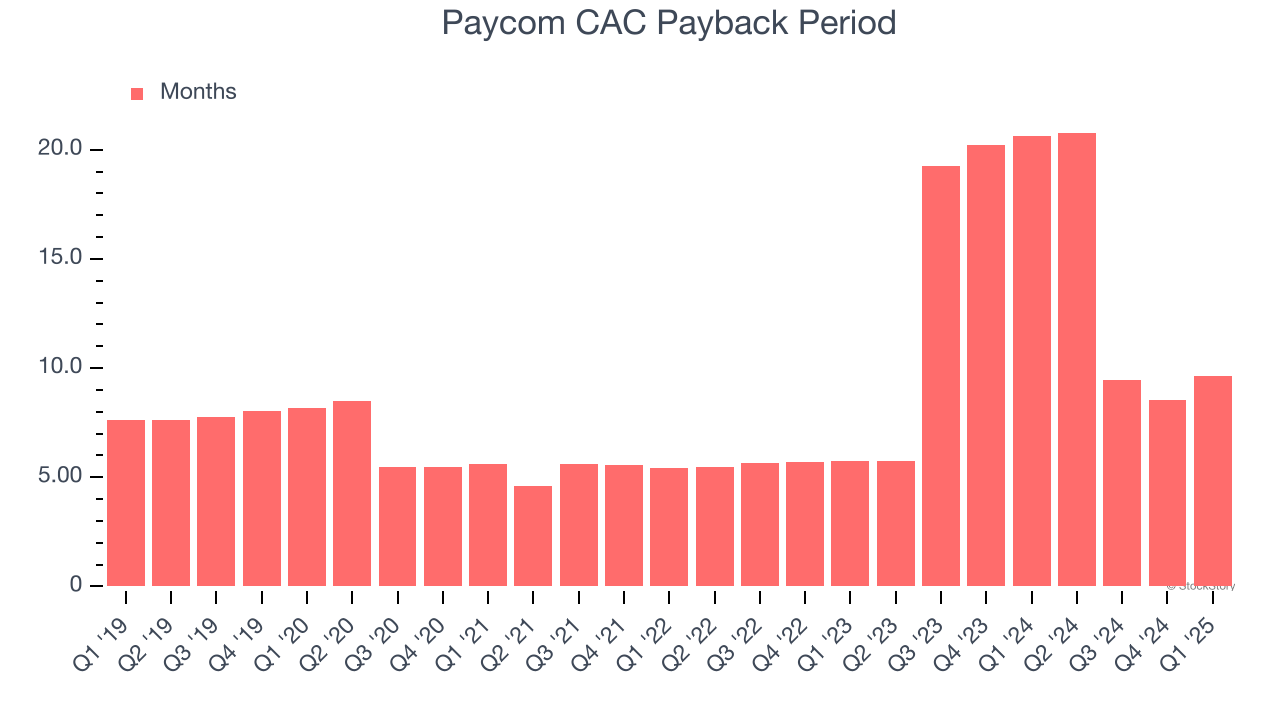

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Paycom is extremely efficient at acquiring new customers, and its CAC payback period checked in at 9.6 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

One Reason to be Careful:

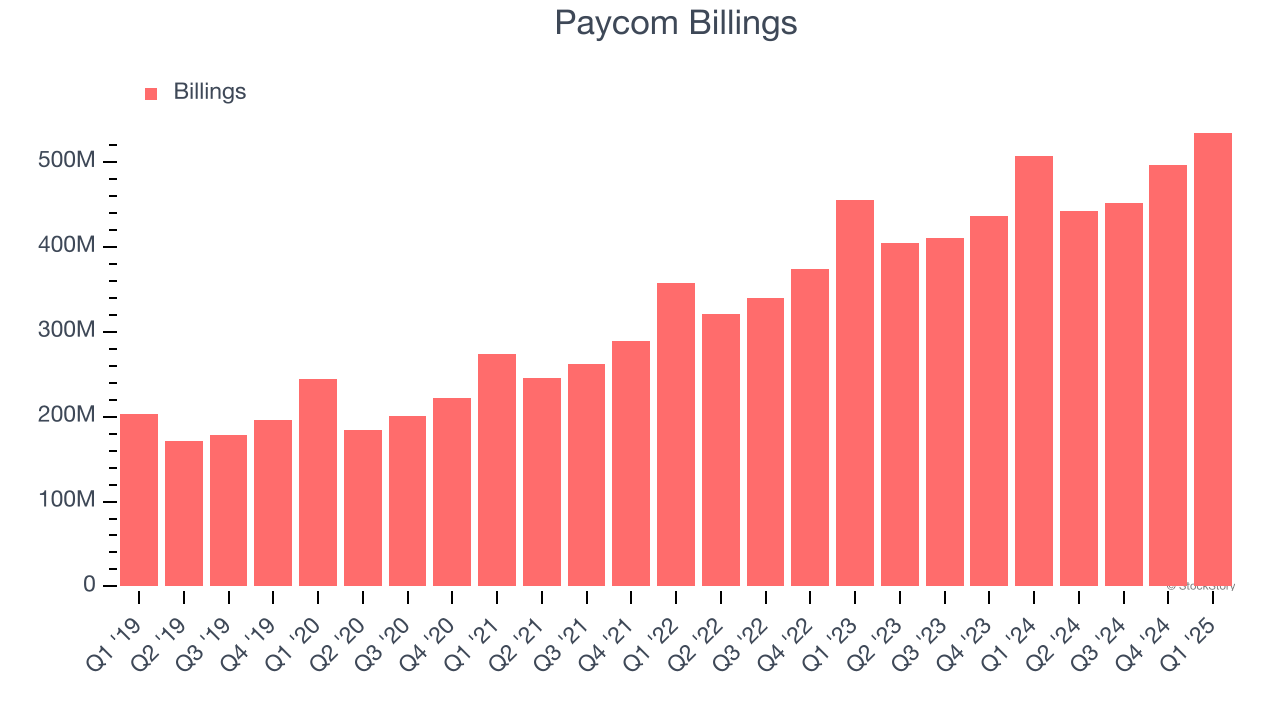

Weak Billings Point to Soft Demand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Paycom’s billings came in at $534.6 million in Q1, and over the last four quarters, its year-on-year growth averaged 9.7%. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Final Judgment

Paycom’s merits more than compensate for its flaws, and with its shares topping the market in recent months, the stock trades at 6.3× forward price-to-sales (or $232.23 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Paycom

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.