Wrapping up Q1 earnings, we look at the numbers and key takeaways for the renewable energy stocks, including Blink Charging (NASDAQ:BLNK) and its peers.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 18 renewable energy stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 5.2% while next quarter’s revenue guidance was 1.1% above.

Luckily, renewable energy stocks have performed well with share prices up 14.5% on average since the latest earnings results.

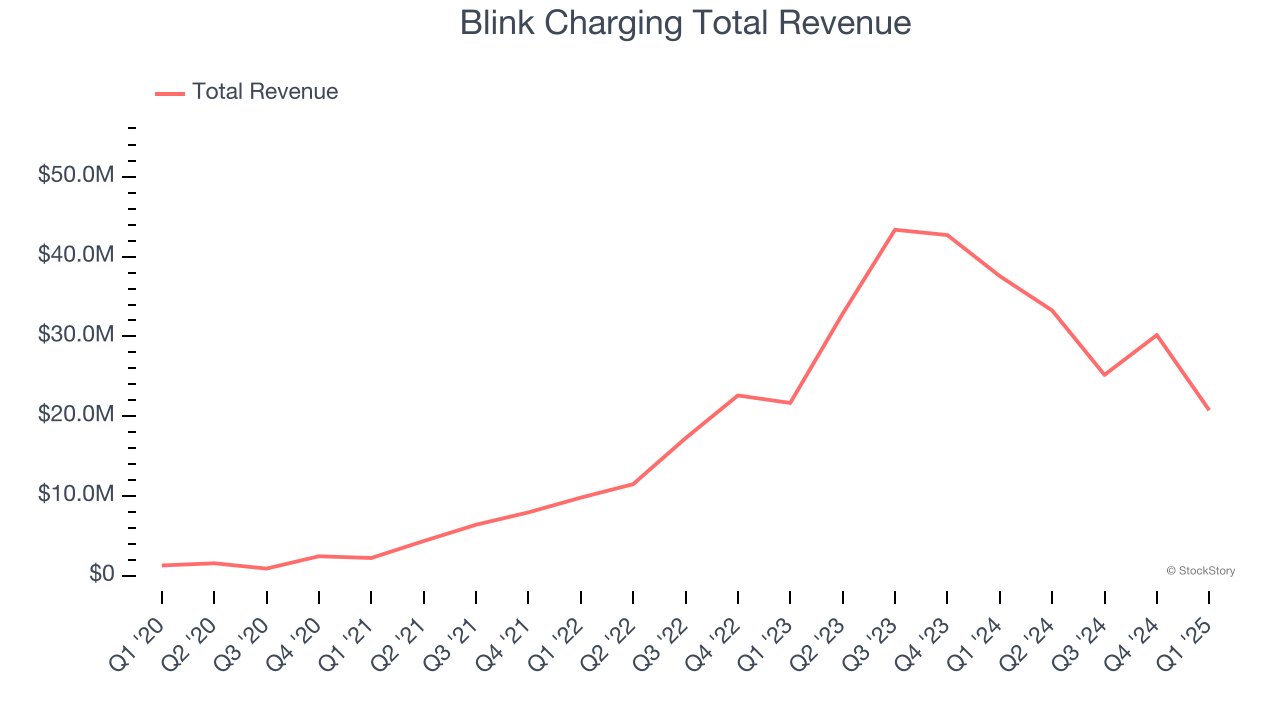

Weakest Q1: Blink Charging (NASDAQ:BLNK)

One of the first EV charging companies to go public, Blink Charging (NASDAQ:BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $20.75 million, down 44.8% year on year. This print fell short of analysts’ expectations by 24.3%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

Blink Charging delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Interestingly, the stock is up 9% since reporting and currently trades at $0.94.

Is now the time to buy Blink Charging? Access our full analysis of the earnings results here, it’s free.

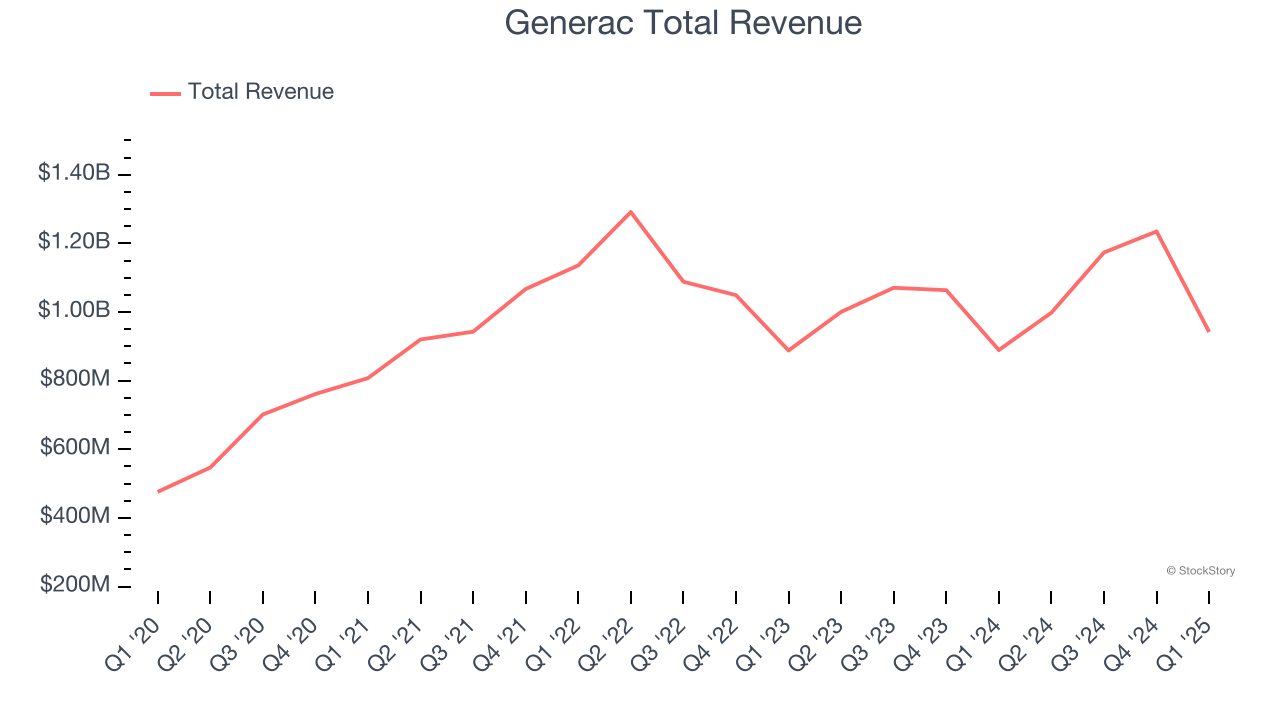

Best Q1: Generac (NYSE:GNRC)

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE:GNRC) offers generators and other power products for residential, industrial, and commercial use.

Generac reported revenues of $942.1 million, up 5.9% year on year, outperforming analysts’ expectations by 2.3%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 11% since reporting. It currently trades at $125.59.

Is now the time to buy Generac? Access our full analysis of the earnings results here, it’s free.

First Solar (NASDAQ:FSLR)

Headquartered in Arizona, First Solar (NASDAQ:FSLR) specializes in manufacturing solar panels and providing photovoltaic solar energy solutions.

First Solar reported revenues of $844.6 million, up 6.4% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue and EPS guidance missing analysts’ expectations.

Interestingly, the stock is up 4.5% since the results and currently trades at $143.32.

Read our full analysis of First Solar’s results here.

Fluence Energy (NASDAQ:FLNC)

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ:FLNC) helps store renewable energy sources with battery systems.

Fluence Energy reported revenues of $431.6 million, down 30.7% year on year. This result surpassed analysts’ expectations by 29.8%. However, it was a slower quarter as it recorded full-year revenue guidance missing analysts’ expectations.

Fluence Energy achieved the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is up 24.8% since reporting and currently trades at $5.61.

Read our full, actionable report on Fluence Energy here, it’s free.

Sunrun (NASDAQ:RUN)

Helping homeowners use solar energy to power their homes, Sunrun (NASDAQ:RUN) provides residential solar electricity, specializing in panel installation and leasing services.

Sunrun reported revenues of $504.3 million, up 10.1% year on year. This number topped analysts’ expectations by 4%. It was a very strong quarter as it also logged an impressive beat of analysts’ customer base estimates and a solid beat of analysts’ EPS estimates.

The company added 25,428 customers to reach a total of 1.07 million. The stock is down 17.4% since reporting and currently trades at $6.10.

Read our full, actionable report on Sunrun here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.