Water analytics and treatment company Veralto (NYSE:VLTO) announced better-than-expected revenue in Q2 CY2025, with sales up 6.4% year on year to $1.37 billion. Its GAAP profit of $0.89 per share was 4.3% above analysts’ consensus estimates.

Is now the time to buy Veralto? Find out by accessing our full research report, it’s free.

Veralto (VLTO) Q2 CY2025 Highlights:

- Revenue: $1.37 billion vs analyst estimates of $1.34 billion (6.4% year-on-year growth, 2% beat)

- EPS (GAAP): $0.89 vs analyst estimates of $0.85 (4.3% beat)

- Operating Margin: 22.8%, in line with the same quarter last year

- Free Cash Flow Margin: 23.6%, up from 18.6% in the same quarter last year

- Market Capitalization: $25.6 billion

"We delivered a strong second quarter led by outstanding commercial execution and steady, broad-based customer demand. Our rigorous application of the Veralto Enterprise System continued to support global growth and operating discipline, while also helping mitigate impacts from changes in global trade policies," said Jennifer L. Honeycutt, President and Chief Executive Officer.

Company Overview

Spun off from Danaher in 2023, Veralto (NYSE:VLTO) provides water analytics and treatment solutions.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last four years, Veralto grew its sales at a sluggish 4% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Veralto’s annualized revenue growth of 4.1% over the last two years aligns with its four-year trend, suggesting its demand was consistently weak.

This quarter, Veralto reported year-on-year revenue growth of 6.4%, and its $1.37 billion of revenue exceeded Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 3.7% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not catalyze better top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

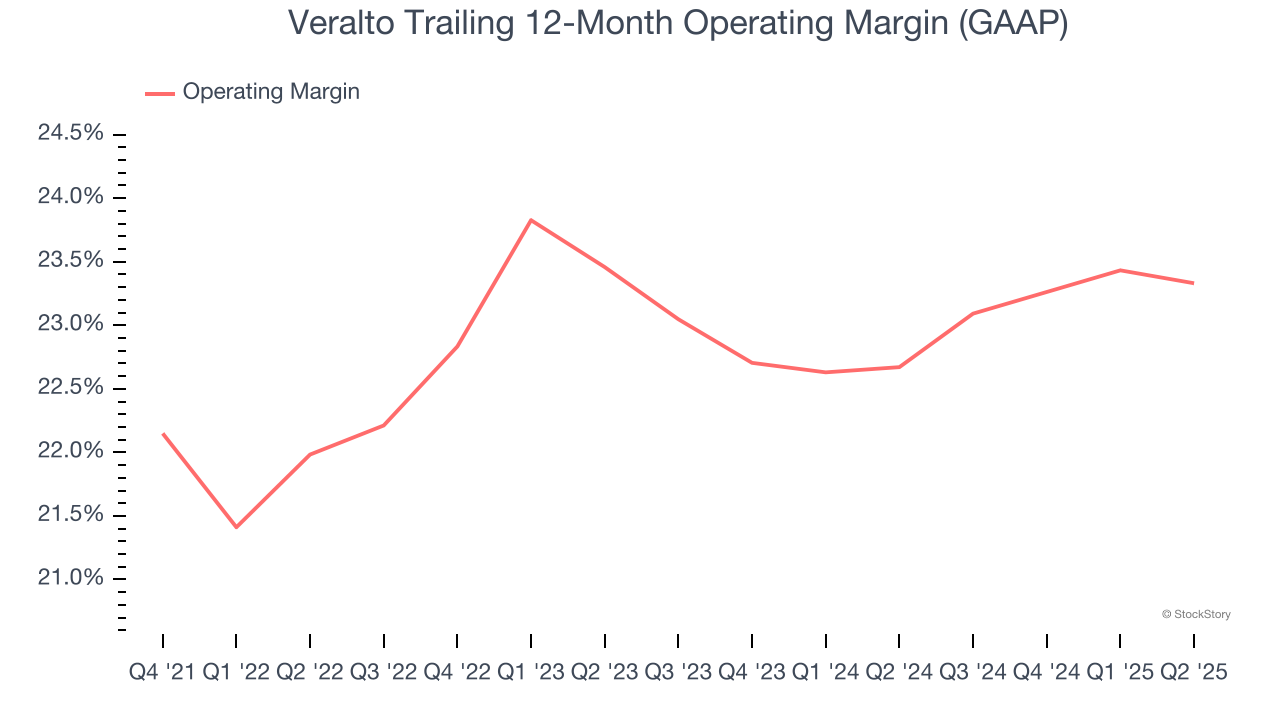

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Veralto’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 22.8% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Veralto’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Veralto generated an operating margin profit margin of 22.8%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

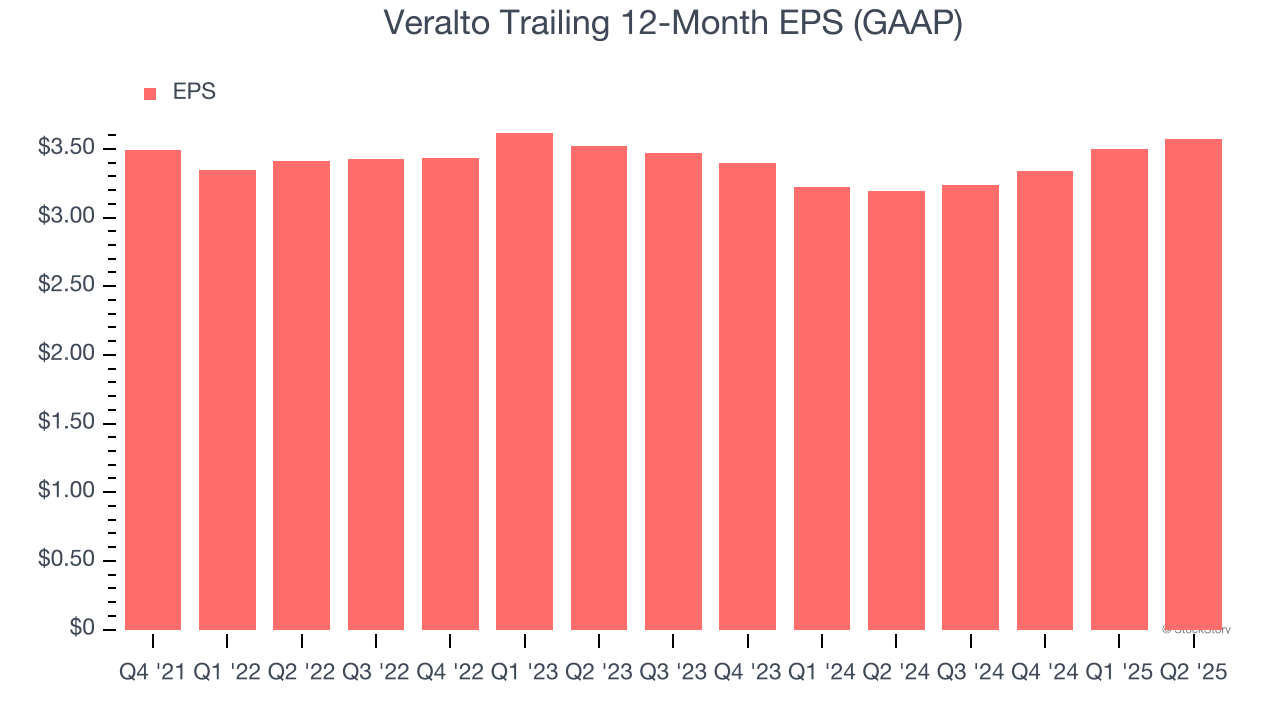

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Veralto’s flat EPS over the last four years was below its 4% annualized revenue growth. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

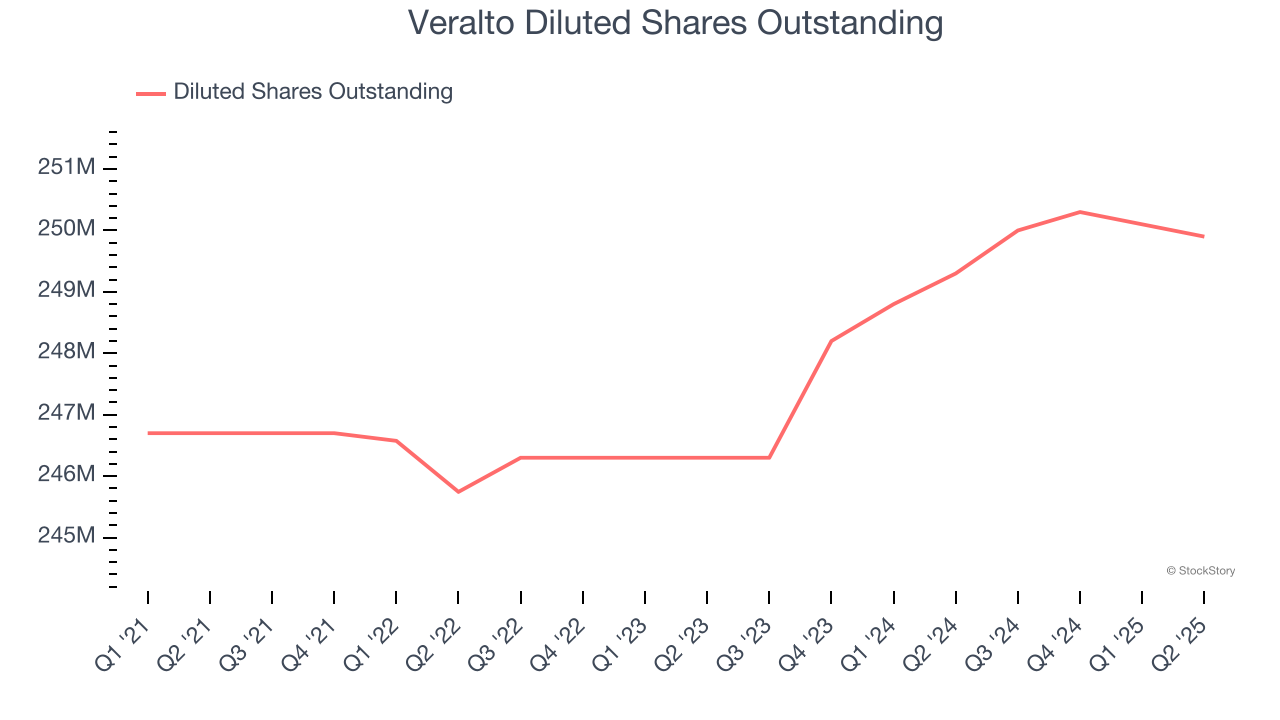

We can take a deeper look into Veralto’s earnings to better understand the drivers of its performance. Veralto recently raised equity capital, and in the process, grew its share count by 1.3% over the last four years. This has resulted in muted earnings per share growth but doesn’t tell us as much about its future. We prefer to look at operating and free cash flow margins in these situations.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Unfortunately for Veralto, things didn’t get any better over the last two years as its EPS didn’t budge. We hope its earnings can grow in the coming years.

In Q2, Veralto reported EPS at $0.89, up from $0.81 in the same quarter last year. This print beat analysts’ estimates by 4.3%. Over the next 12 months, Wall Street expects Veralto’s full-year EPS of $3.57 to grow 4.3%.

Key Takeaways from Veralto’s Q2 Results

We enjoyed seeing Veralto beat analysts’ revenue and EPS expectations this quarter. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $103.75 immediately after reporting.

Veralto may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.