Stock photography and footage provider Shutterstock (NYSE:SSTK) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 21.3% year on year to $267 million. Its non-GAAP profit of $1.19 per share was 5.3% above analysts’ consensus estimates.

Is now the time to buy Shutterstock? Find out by accessing our full research report, it’s free.

Shutterstock (SSTK) Q2 CY2025 Highlights:

- Revenue: $267 million vs analyst estimates of $248.3 million (21.3% year-on-year growth, 7.5% beat)

- Adjusted EPS: $1.19 vs analyst estimates of $1.13 (5.3% beat)

- Adjusted EBITDA: $82.24 million vs analyst estimates of $66.7 million (30.8% margin, 23.3% beat)

- Operating Margin: 13%, up from 9.4% in the same quarter last year

- Free Cash Flow Margin: 5.8%, similar to the previous quarter

- Paid Downloads: 112.6 million, up 79.2 million year on year

- Billings: $267.5 million at quarter end, up 28.3% year on year

- Market Capitalization: $698.4 million

Commenting on the Company's performance, Paul Hennessy, the Company's Chief Executive Officer, said, "I am pleased to report that Shutterstock set new high water marks in the second quarter, achieving record levels in both Revenue and Adjusted EBITDA. Our complete suite of offerings, from creative content to custom creative solutions to AI model inputs to our GIPHY distribution is now more than ever enabling us to fuel great work for our customers."

Company Overview

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE:SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

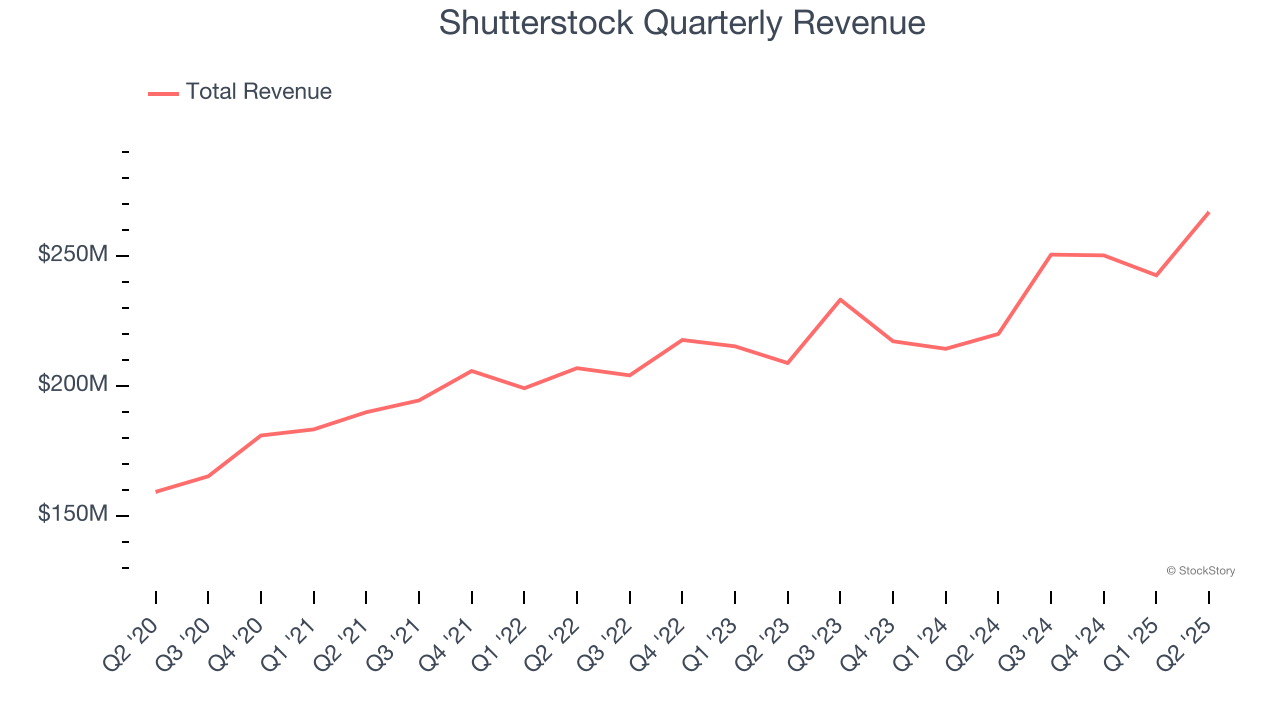

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Shutterstock grew its sales at a tepid 7.8% compounded annual growth rate. This fell short of our benchmark for the consumer internet sector and is a tough starting point for our analysis.

This quarter, Shutterstock reported robust year-on-year revenue growth of 21.3%, and its $267 million of revenue topped Wall Street estimates by 7.5%.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Paid Downloads

Request Growth

As an online marketplace, Shutterstock generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, Shutterstock’s paid downloads, a key performance metric for the company, increased by 77.7% annually to 112.6 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q2, Shutterstock added 79.2 million paid downloads, leading to 237% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating request growth.

Revenue Per Request

Average revenue per request (ARPR) is a critical metric to track because it measures how much the company earns in transaction fees from each request. ARPR also gives us unique insights into a user’s average order size and Shutterstock’s take rate, or "cut", on each order.

Shutterstock’s ARPR fell over the last two years, averaging 3.9% annual declines. This isn’t great, but the increase in paid downloads is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Shutterstock tries boosting ARPR by taking a more aggressive approach to monetization, it’s unclear whether requests can continue growing at the current pace.

This quarter, Shutterstock’s ARPR clocked in at $2.37. It declined 53.4% year on year, worse than the change in its paid downloads.

Key Takeaways from Shutterstock’s Q2 Results

We were impressed by how significantly Shutterstock blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also excited its number of paid downloads outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 2.8% to $20.37 immediately after reporting.

Shutterstock put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.