Online auto marketplace CarGurus (NASDAQ:CARG) announced better-than-expected revenue in Q2 CY2025, with sales up 7% year on year to $234 million. On the other hand, next quarter’s revenue guidance of $230.5 million was less impressive, coming in 3% below analysts’ estimates. Its non-GAAP profit of $0.57 per share was 4.4% above analysts’ consensus estimates.

Is now the time to buy CarGurus? Find out by accessing our full research report, it’s free.

CarGurus (CARG) Q2 CY2025 Highlights:

- Revenue: $234 million vs analyst estimates of $232.5 million (7% year-on-year growth, 0.7% beat)

- Adjusted EPS: $0.57 vs analyst estimates of $0.55 (4.4% beat)

- Adjusted EBITDA: $77.3 million vs analyst estimates of $74.69 million (33% margin, 3.5% beat)

- Revenue Guidance for Q3 CY2025 is $230.5 million at the midpoint, below analyst estimates of $237.7 million

- Adjusted EPS guidance for Q3 CY2025 is $0.54 at the midpoint, below analyst estimates of $0.55

- EBITDA guidance for Q3 CY2025 is $80.5 million at the midpoint, above analyst estimates of $74.11 million

- Operating Margin: 10.6%, up from -42.8% in the same quarter last year

- Free Cash Flow Margin: 27.9%, up from 26.8% in the previous quarter

- Paying Dealers: 33,095, up 1,743 year on year

- Market Capitalization: $3.14 billion

“Our Marketplace business had another strong quarter, with year-over-year revenue growth of 14%,” said Jason Trevisan, Chief Executive Officer at CarGurus.

Company Overview

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ:CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

Revenue Growth

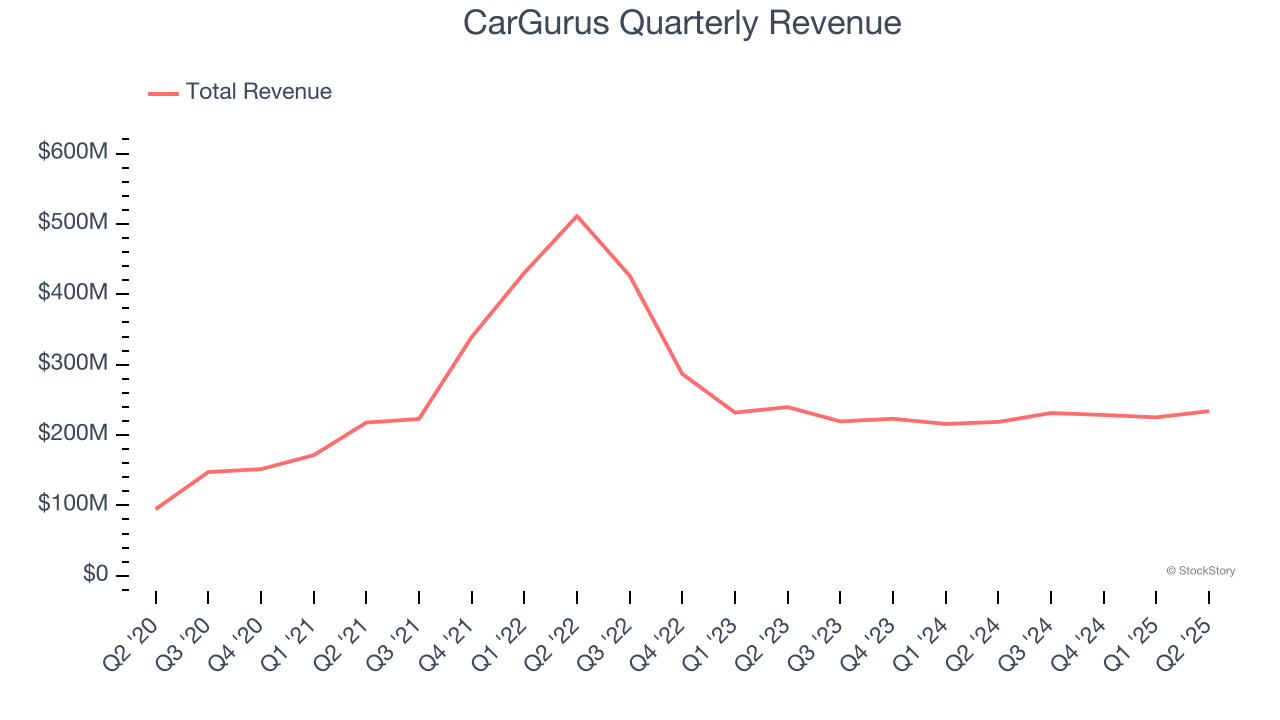

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, CarGurus’s demand was weak and its revenue declined by 15.1% per year. This wasn’t a great result and is a rough starting point for our analysis.

This quarter, CarGurus reported year-on-year revenue growth of 7%, and its $234 million of revenue exceeded Wall Street’s estimates by 0.7%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Paying Dealers

User Growth

As an online marketplace, CarGurus generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

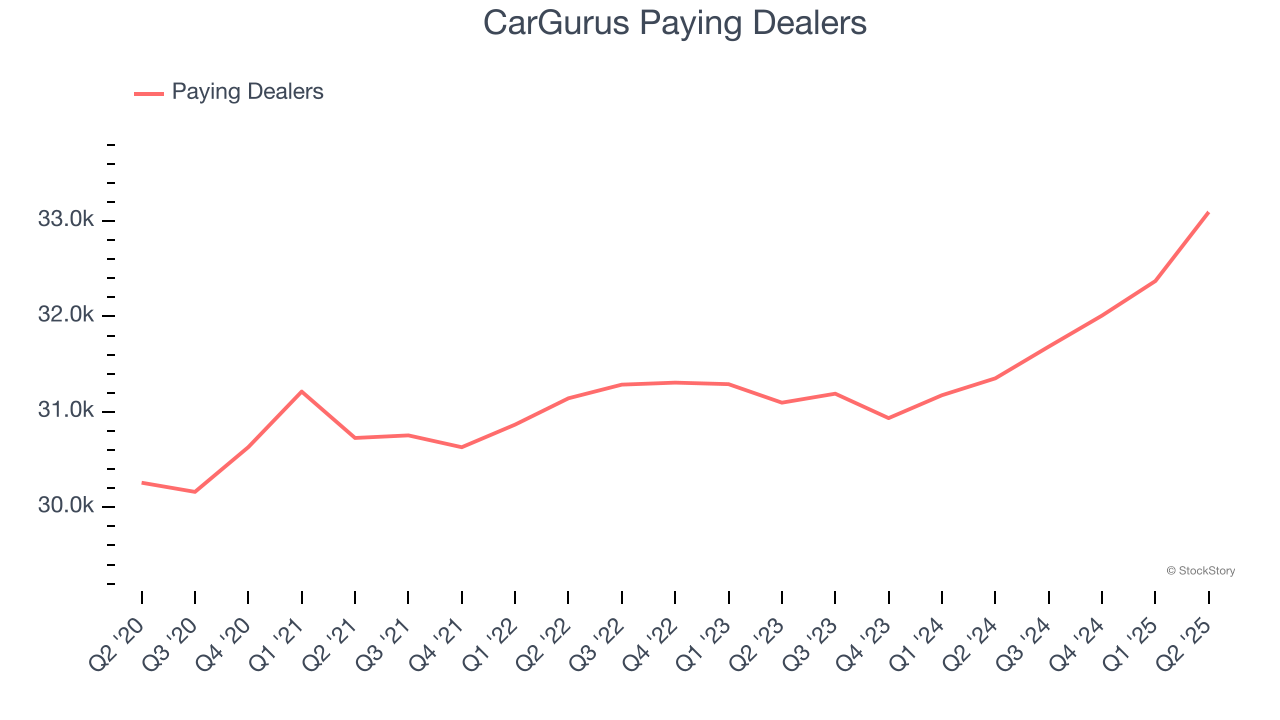

Over the last two years, CarGurus’s paying dealers, a key performance metric for the company, increased by 1.7% annually to 33,095 in the latest quarter. This growth rate is one of the lowest in the consumer internet sector. If CarGurus wants to accelerate growth, it likely needs to engage users more effectively with its existing offerings or innovate with new products.

In Q2, CarGurus added 1,743 paying dealers, leading to 5.6% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

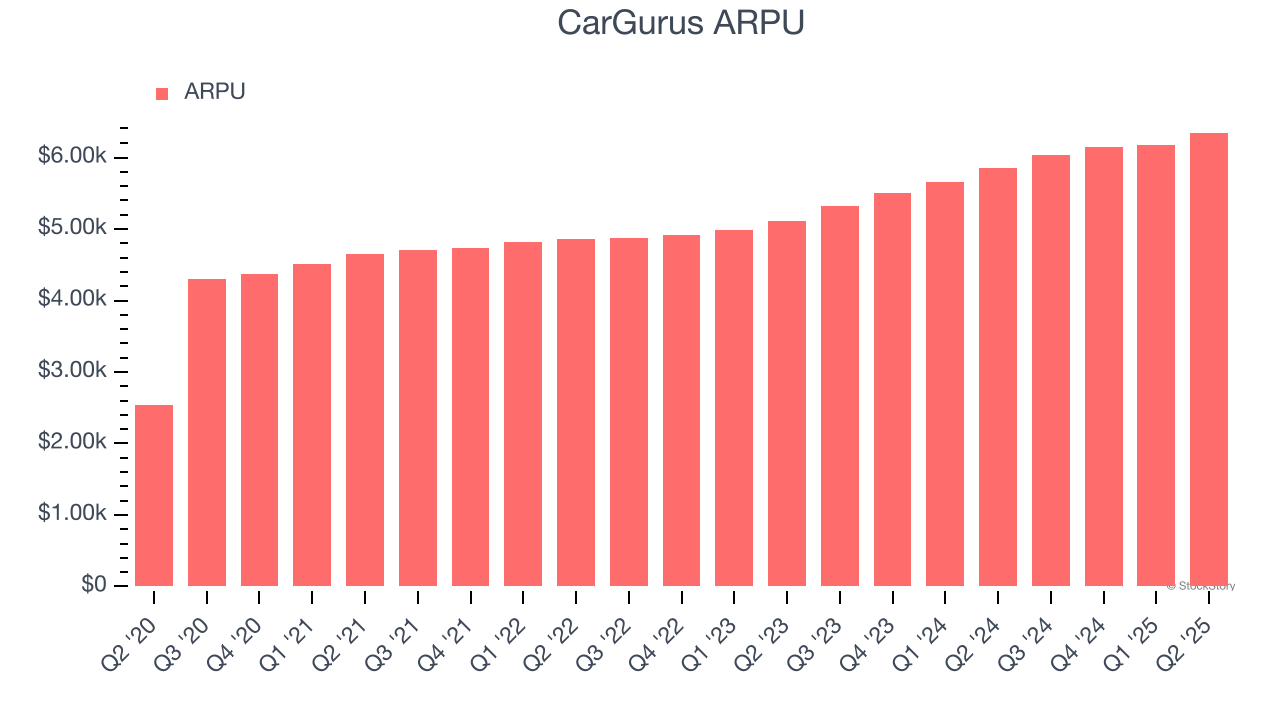

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and CarGurus’s take rate, or "cut", on each order.

CarGurus’s ARPU growth has been exceptional over the last two years, averaging 11.4%. Its ability to increase monetization while growing its paying dealers demonstrates its platform’s value, as its users are spending significantly more than last year.

This quarter, CarGurus’s ARPU clocked in at $6,349. It grew by 8.6% year on year, faster than its paying dealers.

Key Takeaways from CarGurus’s Q2 Results

We were impressed by CarGurus’s EPS and EBITDA, which beat analysts’ expectations. On the other hand, its revenue and EPS guidance for next quarter missed. Overall, this print had some key positives. The stock traded up 5.3% to $33.09 immediately after reporting.

Is CarGurus an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.