Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

Netflix investors are focused on whether the streaming giant can sustain revenue growth as US subscriber momentum cools and strategic ambitions expand.

Via Talk Markets · January 18, 2026

Brown & Brown has increased its dividend payments for 32 consecutive years, including a 10% dividend increase announced on Oct. 23, 2025. Brown & Brown is a member of the exclusive Dividend Aristocrats list thanks to its long dividend growth streak.

Via Talk Markets · January 18, 2026

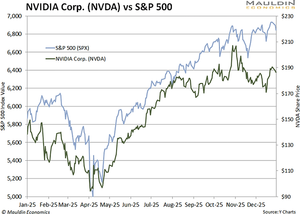

Markets are mostly range-bound, but precious metals and semiconductors remain

Via Talk Markets · January 18, 2026

The Trump administration on Thursday unveiled what it called the “Great Healthcare Plan,” a broad framework aimed at addressing healthcare affordability, drug prices, and insurance transparency.

Via Talk Markets · January 18, 2026

Success in the NQ requires identifying key levels (like the 62) and trusting the immediate response. A 50-handle move shouldn't be sweat; it should be execution.

Via Talk Markets · January 18, 2026

MSFT announced 2 new multi-year carbon credit purchase deals, representing nearly 3 million tonnes of carbon removal, with the new agreements expanding the tech giant’s already substantial lead as the largest corporate purchaser of carbon removal.

Via Talk Markets · January 18, 2026

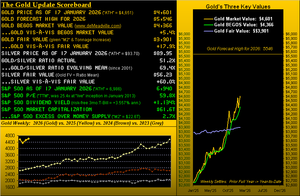

Gold and Silver hit record highs, but valuation and technicals suggest a near-term pullback. Despite

Via Talk Markets · January 18, 2026

Market breadth has been strong and the overbought small caps are leading the way upward.

Via Talk Markets · January 17, 2026

Via Talk Markets · January 17, 2026

Super Micro could eventually be a good tech stock to own again, and it's tempting to build positions in SMCI at under $30 a share. Still, investors may need more reassurance that Super Micro’s growth will indeed continue

Via Talk Markets · January 18, 2026

The Australian dollar continues to see a lot of choppy behavior as we continue to hang around the 0.67 level, which is an area that I think has been like a magnet and an area that I think a lot of people will be paying close attention to.

Via Talk Markets · January 18, 2026

American tech heavyweights do not report their December quarter until the week after. Ahead of this, the Nasdaq 100 continues to act lethargic.

Via Talk Markets · January 18, 2026

Intel stock gains analyst upgrades from Citigroup and TD Cowen to $50 targets as foundry business and server CPU demand drive renewed Wall Street interest.

Via Talk Markets · January 18, 2026

The idea is not higher returns at all costs but instead to have a portfolio that

Via Talk Markets · January 17, 2026

We discuss whether indeed a Great Rotation is underway, 2026 outlook for GDP growth, bonds, inflation, the U.S. dollar and the Federal Reserve.

Via Talk Markets · January 17, 2026

Via Talk Markets · January 17, 2026

Via Talk Markets · January 17, 2026

The top 10 stocks in the S&P 500 now account for roughly 40% of the index’s total market capitalization. From 1880 to 2010, the top 10 averaged about 24% of the index.

Via Talk Markets · January 17, 2026

It appears likely we will soon see a string of months where annual inflation is running 2.5% or below. That’s within shouting distance of the Federal Reserve’s target and may raise the odds of more rate cuts this year.

Via Talk Markets · January 17, 2026

Donald Trump started 2026 by announcing a plan to increase annual military spending by $600 billion for next year – meaning that the military budget would reach a total of $1.5 trillion.

Via Talk Markets · January 17, 2026

Markets entered the week at record levels and were challenged by a wave of political and geopolitical headlines that tested investor confidence. Policy rhetoric weighed on the financial sector, and geopolitics continued to influence energy stocks.

Via Talk Markets · January 17, 2026

The S&P 500 seems to be stuck. Money is rotating inside equities but not flowing in. Bonds are selling off. This is just not the time to chase high-flyers. With all of this in mind, I'm looking at one number before I buy anything right now: beta.

Via Talk Markets · January 17, 2026

The estimated costs of the Fed’s building renovation project have risen from $1.9 billion to $2.5 billion.

Via Talk Markets · January 17, 2026

Via Talk Markets · January 16, 2026

The gold and silver prices are down on Friday after another wild week in the precious metals markets.

Via Talk Markets · January 16, 2026

With the fourth-quarter 2025 earnings season about to start, investors are zeroing in on three pure-play quantum computing stocks poised to deliver solid results: D-Wave Quantum, Rigetti, and IonQ. How should investors approach these stocks?

Via Talk Markets · January 17, 2026

Almost a week on from 'that' video from Fed Chair Powell, insisting that a criminal investigation against him is all about exerting pressure to cut rates, and markets have remained unfazed. Is it simply because nothing has escalated since?

Via Talk Markets · January 17, 2026

UnitedHealth stock has certainly taken a beating over the past year. The shares have fallen down roughly 36% to 50%, depending on the measurement period. Yet, Bernstein analyst Lance Wilkes has named it his “top healthcare pick for 2026.

Via Talk Markets · January 17, 2026

If yields continue to move higher and volatility begins to expand, implied volatility across bonds—and equities and credit—could likely rise as well.

Via Talk Markets · January 17, 2026

Bitmine Immersion has positioned itself as a pioneering Ethereum treasury company. However, Bitmine's latest move raised some eyebrows: a whopping $200 million investment in Beast Industries, the multimedia empire of YouTube sensation MrBeast.

Via Talk Markets · January 17, 2026

The ongoing strength in gold, silver, and copper is driven by long-term macro and industrial forces, not just short-term geopolitical headlines.

Via Talk Markets · January 16, 2026

Here is a short look at the 10 largest companies by market capitalization as of Saturday, Jan. 17, 2026. Additionally, I have included the percentages of their gains on a year-to-date basis. Let's dive into the numbers.

Via Talk Markets · January 17, 2026

Someone recently dropped $238,000 on far out-of-the-money puts for Tesla stock. Specifically, the $250 strike that expires Jan. 31. This is a pattern we've seen before. And it preceded major selloffs in other mega-cap names. Let's take a look.

Via Talk Markets · January 17, 2026

The phrase, 'ETF slop,' was the focal point of an episode of the Rational Reminder podcast. It's a long one, but the key point was to question whether newer ETFs actually benefit customers or not. Today, I'd like to add to the discussion.

Via Talk Markets · January 17, 2026

In this video, we break down two headline-driven market shocks tied to Trump policy pressure—and what they could mean for investors.

Via Talk Markets · January 17, 2026

As risk appetite cooled, some AI stocks experienced steep pullbacks in 2025. Yet, with investor interest in more niche AI infrastructure once again reemerging, these previously beaten down names are showing early signs of renewed momentum.

Via Talk Markets · January 17, 2026

At the end of a historic super cycle, it’s either Bubble bursts or Bubble excess that goes to even crazier extremes. Crazier extremes owned 2025 – at home and abroad.

Via Talk Markets · January 17, 2026

Congrats to Trump for moving Canada and China closer together.

Via Talk Markets · January 17, 2026

The U.S. dollar mostly consolidated against the G10 currencies last week

Via Talk Markets · January 17, 2026

Non-fuel import prices rose 0.1% for the month and 0.7% over the last year. It doesn’t look like exporters are eating the tariffs.

Via Talk Markets · January 17, 2026

The real solution to the affordability crisis and frozen real estate market is to allow interest rates to rise, which will cause home values to fall more in line with incomes.

Via Talk Markets · January 17, 2026

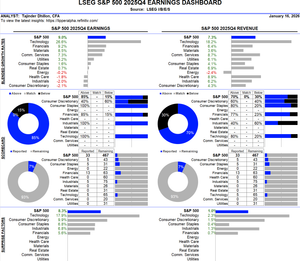

The 2025 Q4 earnings season is in full swing, with results from the big banks this week kicking the period into a much higher gear.

Via Talk Markets · January 17, 2026

AI gives regions and companies a chance to upgrade productivity before competitive disadvantages become locked in.

Via Talk Markets · January 17, 2026

U.S. equity markets delivered mixed performance last week. Major indices generally held near record levels even as volatility increased and macro and policy risks surfaced.

Via Talk Markets · January 17, 2026

The weight-loss drug boom didn’t just spark a health revolution—it’s triggering a retail earthquake.

Via Talk Markets · January 17, 2026

The total return for the S&P 500 Index in 2025 equaled 17.88%, and excluding the Mag 7 stocks, the index’s total return equaled 10.36%.

Via Talk Markets · January 17, 2026

The average number of jobs added per month over the past year was only 48,000. That’s less than a third of average monthly job growth reported during the previous year.

Via Talk Markets · January 17, 2026

Alphabet challenges U.S. ruling, seeking to preserve search defaults amid legal and market uncertainty.

Via Talk Markets · January 17, 2026

Since last April, the total number of jobs in the economy (pending benchmark revisions) has grown by a whopping 93,000.

Via Talk Markets · January 17, 2026

Job growth had slowed to a trickle in the last three months of the Trump administration, the strong bounce back from the spring shutdown was over.

Via Talk Markets · January 17, 2026

Clean energy developer and operator Clearway announced a series of new long-term power purchase agreements with Google, providing the tech giant with nearly 1.2 GW of carbon-free energy to power its data centers

Via Talk Markets · January 17, 2026

As we head into 2026, healthcare stands out as one of the most dislocated areas of the market. One of our favorite ideas within the sector is Pfizer Inc., which has climbed its own crowded wall of worry on top of the broader healthcare exodus

Via Talk Markets · January 17, 2026

Silver has broken out of a historic 45-year base with a $96 near-term target and far higher long-term potential. Ratios versus the S&P 500 and MAG 7 signal a major capital rotation into silver, gold, and mining ETFs.

Via Talk Markets · January 17, 2026

In this video lesson, I review the overall market and three new swing setups ahead of Tuesday's session.

Via Talk Markets · January 16, 2026

In this week's video, we'll review the latest charts and data to help us better understand a prudent strategy for MAG 7 concentration risk anxiety.

Via Talk Markets · January 16, 2026

If you are staring at a gap and wondering whether to chase it or sell it, you are missing the bigger picture. To master swing trading, you have to understand the psychology behind gaps.

Via Talk Markets · January 16, 2026

Sara Frueh interviews David Autor on the subject: “How Is AI Shaping the Future of Work?”. Here are some snippets that caught my eye, but it’s worth reading the essay

Via Talk Markets · January 16, 2026

EUR/USD weakens as solid US jobless claims and factory inflation lift Treasury yields.

Via Talk Markets · January 16, 2026

Omega Healthcare Investors Inc is a real estate investment trust, which provides financing and capital to the long-term healthcare industry

Via Talk Markets · January 16, 2026

The last time small caps broke out of a multi-year base like this, they crushed large caps by over 20% in the following year. That same setup is forming right now. And almost nobody is paying attention.

Via Talk Markets · January 16, 2026

Stocks popped and flopped. Gold and silver were under pressure, as is typical for a monthly stock market option expiration. VIX is subdued.

Via Talk Markets · January 16, 2026

Plenty of results are still to come. But at this early stage, the revenue beats percentage is tracking below the historical average, with all the other metrics in the historical range.

Via Talk Markets · January 16, 2026

The market appeared to view the financing as strategic rather than defensive, given Broadcom’s strong cash generation and profitability profile.

Via Talk Markets · January 16, 2026

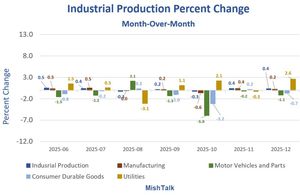

AI Boom. Utilities provided 88.8% of the increase in IP this month.

Via Talk Markets · January 16, 2026

The S&P 500 and Nasdaq settled slightly below breakeven on Friday, as all three major benchmarks succumbed to weekly losses.

Via Talk Markets · January 16, 2026

One of the hallmarks of the Israeli economy is its great resilience during the past two years as it dealt with wars on all its borders.

Via Talk Markets · January 16, 2026

While Wall Street’s consensus forecasts often grab the headlines, it’s the unexpected twists - the “black swan” events and outlier scenarios - that can truly upend markets.

Via Talk Markets · January 16, 2026

Silver’s vertical moonshot has accelerated into a dangerous extreme parabola. This popular speculative mania fueling frenzied fear-of-missing-out buying will end badly, like all before it.

Via Talk Markets · January 16, 2026

AST SpaceMobile pushed meaningfully higher to print a record high of nearly $120 this morning after being picked as a prime contractor for the SHIELD program.

Via Talk Markets · January 16, 2026

Despite the influence of utility production, this was a positive report.

Via Talk Markets · January 16, 2026

Robinhood stock price is stuck in a bear market after falling by nearly 30% from its highest level in 2025.

Via Talk Markets · January 16, 2026

25Q4Y/Y earnings are expected to be 9.0%. Excluding the energy sector, the Y/Y earnings estimate is 9.4%.

Via Talk Markets · January 16, 2026

Gold and gold stocks are only beginning an era of out-performance when considering a big picture view.

Via Talk Markets · January 16, 2026