Bloom Energy Corporation Class A Common Stock (BE)

134.07

+12.23 (10.04%)

NYSE · Last Trade: Jan 11th, 7:31 PM EST

Defense, AI power demand and deal-driven catalysts powered last week's top large-cap winners, led by sharp surges in RGC, RVMD and a cluster of defense and data-center energy plays.

Via Benzinga · January 11, 2026

It's all about AI and data centers, according to some market professionals tracking the company.

Via The Motley Fool · January 9, 2026

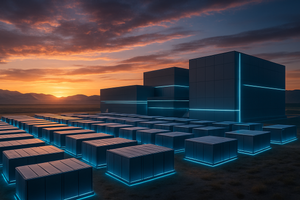

Bloom Energy has a solution to the problem of powering data centers, and it's ready now.

Via The Motley Fool · January 9, 2026

Small caps led the way. Nvidia and AMD fell despite unveiling new AI chips at CES.

Via Investor's Business Daily · January 9, 2026

BE Stock Jumps After AEP Unit Signs $2.65B Deal For Fuel Cells — Analysts Call It A ‘Meaningful Positive’ For Bloom Energystocktwits.com

Via Stocktwits · January 8, 2026

Let’s dig into the relative performance of Enphase (NASDAQ:ENPH) and its peers as we unravel the now-completed Q3 renewable energy earnings season.

Via StockStory · January 8, 2026

As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the renewable energy industry, including Plug Power (NASDAQ:PLUG) and its peers.

Via StockStory · January 8, 2026

In a landmark decision that bridges the gap between massive AI compute demands and sustainable energy solutions, Bloom Energy (NYSE: BE) shares skyrocketed by more than 18% in early trading on January 8, 2026. The surge follows the final regulatory approval for a colossal 1.8-gigawatt (GW) AI data center

Via MarketMinute · January 8, 2026

Bloom Energy shares are up Thursday afternoon following a recent credit agreement that bolsters investor confidence.

Via Benzinga · January 8, 2026

One customer sees fuel cells as a smart way to meet the high power demands for AI computing.

Via The Motley Fool · January 8, 2026

Bloom Energy's stock price nearly quadrupled in 2025. Could the run keep going in 2026?

Via The Motley Fool · January 8, 2026

Shares of Bloom Energy (NYSE: BE) surged more than 18% in early trading today, January 8, 2026, following the announcement of a definitive agreement to provide nearly a gigawatt of power to a monumental AI data center campus in Cheyenne, Wyoming. The deal, which marks one of the largest private

Via MarketMinute · January 8, 2026

Bloom Energy roared above a buy point in Thursday's stock market action on a key data center project approval.

Via Investor's Business Daily · January 8, 2026

Mid-cap stocks have the best odds of scaling into $100 billion corporations thanks to their tested business models and large addressable markets.

But the many opportunities in front of them attract significant competition, spanning from industry behemoths with seemingly infinite resources to small, nimble players with chips on their shoulders.

Via StockStory · January 7, 2026

As the first full week of 2026 unfolds, the clean technology sector finds itself at a crossroads, caught between tightening federal incentives and an insatiable global demand for power. While traditional solar and wind stocks have spent the early days of the new year reeling from the implementation of the

Via MarketMinute · January 7, 2026

Shares of electricity generation and hydrogen production company Bloom Energy (NYSE:BE) jumped 7.3% in the afternoon session after a prominent analyst increased the company's price target to $58, and the company announced a new $600 million credit facility.

Via StockStory · January 7, 2026

The total addressable market for green hydrogen could be over $60 billion by 2030.

Via The Motley Fool · January 6, 2026

Via Benzinga · January 6, 2026

The first trading week of 2026 has delivered a powerful resurgence of the "January Effect," with small-cap stocks staging a massive rally that has outpaced their mega-cap counterparts. As of January 6, 2026, the iShares Russell 2000 ETF (NYSE:IWM) has surged an impressive 6.2%, marking one of the

Via MarketMinute · January 6, 2026

Bloom Energy's solid oxide fuel cells provide a game-changing solution for AI data centers facing grid constraints.

Via Talk Markets · January 6, 2026

The December correction may have provided a good opportunity to own this AI winner.

Via The Motley Fool · January 6, 2026

Large-cap gainers last week were led by FTAI Aviation on its FTAI Power launch, with broad upside across chips (MU/ASML/INTC/TSM/ASE/Sandisk) and AI-driven power plays (Bloom), plus Symbotic and Reddit on policy-driven headlines.

Via Benzinga · January 4, 2026

Brookfield is going all in on AI Infrastructure.

Via The Motley Fool · January 3, 2026

As the opening bells of 2026 ring across Wall Street, the financial landscape is undergoing a profound structural shift. After two years of unprecedented dominance by mega-cap technology and artificial intelligence "builders," the market is witnessing a determined rotation into value and defensive sectors. While the S&P 500 Index

Via MarketMinute · January 2, 2026

Shares of data center products and services company Vertiv (NYSE:VRT)

jumped 8.5% in the morning session after Barclays upgraded the stock to 'Overweight' from 'Equal-Weight' and raised its price target, citing higher earnings estimates.

Via StockStory · January 2, 2026