Latest News

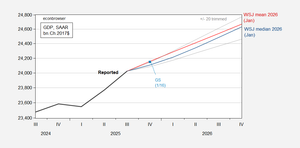

The U.S. labor market has defied expectations of a late-cycle collapse, entering 2026 in a state of "fragile equilibrium" that has calmed recessionary fears on Wall Street. Following a turbulent 2025 characterized by slowing hiring and cooling wage growth, the latest data for December 2025 and early January 2026

Via MarketMinute · January 19, 2026

As the AI revolution enters its most capital-intensive phase yet in early 2026, the industry’s greatest challenge is no longer just the design of smarter algorithms or the procurement of raw silicon. Instead, the global technology sector finds itself locked in a desperate scramble for "Advanced Packaging," specifically the Chip-on-Wafer-on-Substrate (CoWoS) technology pioneered by Taiwan [...]

Via TokenRing AI · January 19, 2026

While the mean forecast is for around 2.2% growth in 2026, the trimmed 20% band suggests some downside risks.

Via Talk Markets · January 19, 2026

As of January 19, 2026, the financial landscape has undergone a profound transformation. After years of dominance by a handful of mega-cap technology titans, the market has finally embraced a "Great Rotation," shifting the spotlight toward small-cap companies, cyclical industries, and international equities. This broadening of market leadership represents a

Via MarketMinute · January 19, 2026

The financial world was rocked this week as the Department of Justice (DOJ) launched an unprecedented criminal investigation into Federal Reserve Chair Jerome Powell. The probe, which centers on allegations of misleading Congress regarding multi-billion dollar renovations at the Fed's Washington headquarters, has sent shockwaves through global markets and sparked

Via MarketMinute · January 19, 2026

As of January 19, 2026, the global semiconductor landscape is witnessing a dramatic divergence in the fortunes of the two pillars of power electronics: Silicon Carbide (SiC) and Gallium Nitride (GaN). While the SiC sector is currently weathering a painful correction cycle defined by upstream overcapacity and aggressive price wars, GaN has emerged as the [...]

Via TokenRing AI · January 19, 2026

As the IRS officially opens the 2026 tax filing season today, January 19, 2026, the American economy is standing on the precipice of a massive, unintended fiscal injection. Analysts are projecting a record-breaking tax-refund windfall between $100 billion and $150 billion over the next three months—a surge primarily fueled

Via MarketMinute · January 19, 2026

The semiconductor industry has reached a historic inflection point in January 2026, as the "Great Flip" from front-side to backside power delivery becomes the defining standard for the sub-2nm era. At the heart of this architectural shift is Intel Corporation (NASDAQ: INTC) and its proprietary PowerVia technology. By moving a chip’s power delivery network to [...]

Via TokenRing AI · January 19, 2026

The Trump administration has officially unveiled a high-stakes proposal to allow Americans to tap into their 401(k) retirement accounts to purchase homes, a move that could fundamentally redefine the relationship between retirement savings and real estate. By removing the traditional 10% early withdrawal penalty for first-time and qualified homebuyers,

Via MarketMinute · January 19, 2026

The ascending growth investor went hunting for deals ahead of the holiday weekend.

Via The Motley Fool · January 19, 2026

The semiconductor industry reached a historic milestone this month as Intel Corporation (NASDAQ: INTC) officially transitioned its glass substrate technology into high-volume manufacturing (HVM). Announced during CES 2026, the shift from traditional organic materials to glass marks the most significant change in chip packaging in over two decades. By moving beyond the physical limitations of [...]

Via TokenRing AI · January 19, 2026

The global media landscape is currently witnessing its most transformative upheaval in decades as a fierce bidding war for Warner Bros. Discovery (NASDAQ: WBD) reaches a boiling point. Following years of post-merger integration and aggressive debt reduction, WBD has become the ultimate prize in a consolidation race that pits the

Via MarketMinute · January 19, 2026

As of January 2026, the global artificial intelligence landscape has shifted from a race between corporate titans to a high-stakes competition between nation-states. Driven by the need for strategic autonomy and a desire to decouple from a volatile global supply chain, a new era of "Sovereign AI" has arrived. This movement is defined by massive [...]

Via TokenRing AI · January 19, 2026

Wells Fargo & Company (NYSE: WFC) reported its fourth-quarter and full-year 2025 financial results on January 14, 2026, delivering a performance that signaled a definitive end to its years of regulatory stagnation. The San Francisco-based lender posted an adjusted earnings per share (EPS) of $1.76, comfortably exceeding the 16.9%

Via MarketMinute · January 19, 2026

As of January 19, 2026, the global computing landscape has undergone its most radical transformation since the transition from the command line to the graphical user interface. The "AI PC" revolution, which began as a tentative promise in 2024, has reached a fever pitch, with over 55% of all new PCs sold today featuring dedicated [...]

Via TokenRing AI · January 19, 2026

As of January 19, 2026, the cloud of uncertainty that once threatened to derail the global semiconductor industry has finally lifted. Following a multi-year legal saga that many analysts dubbed an "existential crisis" for the Windows-on-Arm and Android ecosystems, Qualcomm (NASDAQ: QCOM) has emerged as the definitive victor in its high-stakes battle against Arm Holdings [...]

Via TokenRing AI · January 19, 2026

As the financial world gathers for the start of the 2026 fiscal year, Bank of America (NYSE:BAC) CEO Brian Moynihan has delivered a strikingly optimistic assessment of the U.S. economy. Speaking at the World Economic Forum in Davos on January 19, 2026, Moynihan characterized the current environment as

Via MarketMinute · January 19, 2026

In a move once considered unthinkable in the cutthroat world of semiconductor manufacturing, lifelong rivals Intel Corporation (NASDAQ: INTC) and Advanced Micro Devices, Inc. (NASDAQ: AMD) have solidified their "hell freezes over" alliance through the x86 Ecosystem Advisory Group (EAG). Formed in late 2024 and reaching a critical technical maturity in early 2026, this partnership [...]

Via TokenRing AI · January 19, 2026

NEW YORK — JPMorgan Chase (NYSE:JPM) officially inaugurated the 2026 bank earnings season this week, delivering a complex financial performance that left Wall Street grappling with a "mixed bag" of record-breaking trading results and startlingly high future expense projections. While the bank handily beat adjusted earnings expectations, a combination of

Via MarketMinute · January 19, 2026

They are unlikely to resort to dividend cuts anytime soon.

Via The Motley Fool · January 19, 2026

In a move that has sent shockwaves through the global financial landscape, Bitcoin has reclaimed the $97,000 milestone as of January 19, 2026, marking a powerful resurgence after a volatile end to the previous year. This latest surge, which saw the premier digital asset peak at $97,924 during

Via MarketMinute · January 19, 2026

As of January 2026, the global technology landscape is undergoing a fundamental restructuring of its hardware foundation. For years, the artificial intelligence (AI) revolution was powered almost exclusively by general-purpose GPUs from vendors like NVIDIA Corp. (NASDAQ: NVDA). However, a new era of "The Silicon Divorce" has arrived. Hyperscale cloud providers and innovative automotive manufacturers [...]

Via TokenRing AI · January 19, 2026

In a move that has sent shockwaves through the American housing market, the administration has officially directed Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) to initiate a massive $200 billion purchase program of mortgage-backed securities (MBS). This intervention, announced earlier this month, represents one of the most aggressive

Via MarketMinute · January 19, 2026

As of January 19, 2026, the artificial intelligence industry is witnessing an unprecedented capital expenditure surge centered on a single, critical component: High-Bandwidth Memory (HBM). With the transition from HBM3e to the revolutionary HBM4 standard reaching a fever pitch, the "memory wall"—the performance gap between ultra-fast logic processors and slower data storage—is finally being dismantled. [...]

Via TokenRing AI · January 19, 2026

In a move that signals a tectonic shift in the American real estate landscape, the White House has formally proposed a sweeping ban on institutional investors purchasing single-family homes. Announced earlier this month on January 7, 2026, the policy aims to curb the "financialization" of the housing market, which critics

Via MarketMinute · January 19, 2026

In a definitive moment for the American semiconductor industry, Intel (NASDAQ: INTC) has officially transitioned its ambitious 18A (1.8nm-class) process node into high-volume manufacturing as of January 2026. This milestone marks the culmination of CEO Pat Gelsinger’s "five nodes in four years" roadmap, a high-stakes strategy designed to restore the company’s manufacturing leadership after years [...]

Via TokenRing AI · January 19, 2026

NEW YORK — In a historic trading session that has sent shockwaves through global capital markets, precious metals reached unprecedented heights today, January 19, 2026. Spot gold surged to a staggering $4,635 per ounce, while silver outpaced its yellow counterpart with a 7.4% daily jump, firmly establishing itself at

Via MarketMinute · January 19, 2026

The release of the November Producer Price Index (PPI) has provided a much-needed sigh of relief for economists and market participants alike. Wholesale prices rose by a modest 0.2% for the month, coming in softer than the 0.3% increase many analysts had forecasted. Even more encouraging was the

Via MarketMinute · January 19, 2026

As of January 2026, the global semiconductor landscape has officially shifted into its most critical transition in over a decade. Taiwan Semiconductor Manufacturing Co. (NYSE: TSM) has successfully transitioned its 2-nanometer (N2) process from pilot lines to high-volume manufacturing (HVM). This milestone marks the definitive end of the FinFET transistor era—a technology that powered the [...]

Via TokenRing AI · January 19, 2026

The U.S. economy entered 2026 on a surprisingly firm footing as newly released data for November 2025 showed retail sales jumped by 0.6%, comfortably outpacing the 0.4% growth forecasted by Wall Street economists. This unexpected surge, which came to light following a historic 43-day federal government shutdown

Via MarketMinute · January 19, 2026

The battle for artificial intelligence supremacy has entered a volatile new chapter as Advanced Micro Devices, Inc. (NASDAQ: AMD) officially begins large-scale deployments of its Instinct MI325X accelerator, a hardware powerhouse designed to directly unseat the market-leading H200 from NVIDIA Corporation (NASDAQ: NVDA). This high-stakes corporate rivalry, centered on massive leaps in memory capacity, has [...]

Via TokenRing AI · January 19, 2026

In a landmark shift for global semiconductor trade, the Trump administration has officially granted Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD) permission to export high-end H200 AI chips to China. The decision, finalized on January 16, 2026, marks the end of a long-standing blanket ban on top-tier silicon,

Via MarketMinute · January 19, 2026

As of January 19, 2026, the artificial intelligence sector has entered a new phase of industrial-scale deployment, driven almost entirely by the ubiquity of NVIDIA's (NASDAQ:NVDA) Blackwell architecture. What began as a highly anticipated hardware launch in late 2024 has evolved into the foundational infrastructure for the "AI Factory" era. Jensen Huang, CEO of NVIDIA, [...]

Via TokenRing AI · January 19, 2026

WASHINGTON, D.C. — In a move that has sent shockwaves through Wall Street and the payments industry, President Donald Trump officially endorsed the Credit Card Competition Act (CCCA) on January 13, 2026. The endorsement, delivered via a series of high-profile statements, marks a significant shift in the political landscape for

Via MarketMinute · January 19, 2026

Realty Income, Vici, and Digital Realty should rise as interest rates decline.

Via The Motley Fool · January 19, 2026

After nearly tripling over the last year, what comes next for Rigetti Computing stock?

Via The Motley Fool · January 19, 2026

The financial sector faced a turbulent start to the week as President Donald Trump intensified his push for a federal 10% cap on credit card interest rates, a cornerstone of his populist economic agenda. The proposal, which aims to provide "temporary and immediate relief" to American consumers, has moved from

Via MarketMinute · January 19, 2026

The global semiconductor landscape underwent a seismic shift last week with the official announcement of the U.S.-Taiwan Semiconductor Trade and Investment Agreement on January 15, 2026. Signed by the American Institute in Taiwan (AIT) and the Taipei Economic and Cultural Representative Office (TECRO), the deal—informally dubbed the "Silicon Pact"—represents the most significant intervention in tech [...]

Via TokenRing AI · January 19, 2026

In a resounding display of financial strength, Morgan Stanley (NYSE: MS) has capped off a record-breaking 2025 by significantly outperforming Wall Street’s fourth-quarter expectations. The banking giant reported a massive 47% surge in investment banking revenue, reaching $2.41 billion, a figure that has sent shockwaves through the financial

Via MarketMinute · January 19, 2026

Brookfield Corporation is one of my highest conviction investments.

Via The Motley Fool · January 19, 2026

For investors, Caterpillar shares’ exposure to AI-driven energy demand adds a “fresh” layer to its traditional construction and mining narrative.

Via Talk Markets · January 19, 2026

Energy Transfer and Western Midstream look like great stocks to buy for income-oriented investors.

Via The Motley Fool · January 19, 2026

Via MarketBeat · January 19, 2026

Apple bulls hope that the consumer tech giant's shares can rise 35% before this year is over.

Via The Motley Fool · January 19, 2026

Over extended market cycles, Israel’s mid-cap equities have often delivered strong growth, driven by their greater sensitivity to domestic economic trends.

Via Talk Markets · January 19, 2026

Favorable quarterly results from the big U.S. banks sparked the Q4 earnings season off to a good start this week, and were complemented by very strong reports from the top investment management firms.

Via Talk Markets · January 19, 2026

If consumer sentiment and employment data don't perk up, Six Flags could take investors on a roller-coaster ride.

Via The Motley Fool · January 19, 2026

The company has an exciting future, but there are headwinds to consider in 2026.

Via The Motley Fool · January 19, 2026

Occidental Petroleum will release its Q4 earnings on Feb. 19, and could hike its dividend per share. Investors could see OXY stock move higher. Meanwhile, shorting out-of-the-money OXY puts provides good income.

Via Barchart.com · January 19, 2026

XRP holds above Ichimoku Cloud against Ethereum, triggering a rare bullish signal after years of resistance on the two-week chart.

Via Talk Markets · January 19, 2026